|

Statistics

Total online: 1 Guests: 1 Users: 0

|

Trade

Overclocking of the Deposit

Overclocking of the Deposit on Forex is a whole philosophy, reflecting the desire of traders are prepared to a specific risk. Tactics of dispersal the trading account often differ in their aggressiveness in terms of capital management, and may also contain special trading techniques that are not used in daily work with moderate risk. Aggressive trading can be a conscious decision, and as absolutely unconscious.

Of course, much depends on the competence of the foreign currency speculator, on his professional level. About that, what is it used for dispersal of the Deposit that is often used in this work, we will discuss below. Let us consider:

1. why do overclocking?

2. distinctive features of the acceleration

3. zero Deposit in Forex

What do you do overclocking of the Deposit?

Situation could be such that people did not appreciate their financial capabilities when I started to engage in currency speculation. In this case, having already learnt some extent, make the market, the trader faces the problem of lack of capital for trading. On the market a lot of speculators whose accounts are not big amounts of money.

If you trade on small deposits, the person will receive though a decent percentage profit, but negligible in monetary form. Unfortunately, this often causes overstatement of risks.

Outputs from such a situation there are only two, namely, to increase the capital on Deposit, so that, while maintaining the profit percentage to earn the money that would suit the person or begin to overstate the risks. Traders who chose the second option, as a rule, begin to do any overclocking on Forex.

Not being able to increase the amount in the account, they have to jeopardize what is already in their possession, to be able to earn more than moderate risks. Often such methods use novice speculators.

Distinctive features of the acceleration

Traders who prefer to disperse their deposits, often believed to be players. Perhaps this statement makes sense, but today, to discuss the risks will not. Instead we list the features of the acceleration of trading account:

• excessive risks

• short-term trade

• the principle of "all or nothing"

• application of special techniques

• a relatively small amount of Deposit

• extremely high yield

Overestimation of risk can expect higher returns. The opposite assumption is also true, i.e., potentially high returns entail higher risks.

All trading systems, which are aimed at very high risk are short-term. Or a trader will see the sense in using medium term trading in the dispersal of your account. Big money in such an aggressive trading speculators try not to use it. This is due, as You've probably guessed, the high risk of such trading. Too high a chance to lose their capital.

The principle of "all or nothing" suggests that constraints losses during acceleration accounts usually are not used. If the position is in the negative, then apply special techniques:

• averaging in Forex

• the martingale system

• locking positions

• pyramiding

About each of the methods used by overclockers deposits, You can read the relevant articles from the following links.

Zero Deposit Forex

For a start, are determined with methods that will apply in their work. Today, let that be pyramiding and averaging, which are widely used in the currency market. To achieve our goal, we will need to draw up a trading plan. Let us denote the integral part of our action plan:

• search the entry point to the beginning of a new trend (the price movement)

• used pyramiding (if the price goes in the right direction)

• apply averaging (if you made a mistake with the entry point)

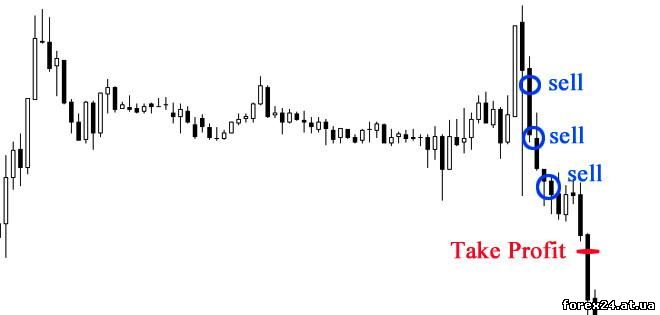

As for pyramiding in need of continued movement of the market price, it is better to look for an entry point using reversal patterns or indicators designed to track changes in market trends. This will allow us to increase the probability of finding the optimal moment to open a position.

The channel breakout strategy which is one of the options of finding the points for the transaction.

If we have correctly identified the beginning of a price movement or just successfully got into the trend, and conclude new transactions in the same direction as the first position. For example, as soon as the market goes 10 pips from the point the conclusion of our deal in the direction we need, we open another position, aimed in the same way as the first transaction. Such actions continue to do 3-5 times, then immediately close all trades, thereby, making a profit.

In the case when the price turns against our trades, it does not matter, one we have a position in the market or more, we begin to averaged. This is the reverse process of pyramiding when as you move market prices against our trades that open a new position, aimed in the same direction as the previous one.

It turns out that we in any case after the conclusion of the first transactions made by the additional operations at intervals of, for example, 10 points. If the price goes the way we want him, we can close the total profit after opening, for example, 5 trades. If the price goes against us, then averaged to find the way out.

Overclocking of the Deposit on Forex every trader risk all of his capital account. This work is considered high-risk for which is taken only in the case if you want to get big profit in a short time. Suggest a few times to think before to start to expose your money to greater risks, to meet with whom during acceleration in any case will have.

|

| Category: Forex | Added by: (06.11.2017)

|

| Views: 2386

| Rating: 0.0/0 |

|