|

Statistics

Total online: 1 Guests: 1 Users: 0

|

Trade

About the breakthroughs in Forex

Incorrect entering a trade on the breakout leads to the fact that instead of fast market movement in our direction, we will be forced to watch "puncture" level with a subsequent price reversal. Today we will look at several ways to protect a Deposit when false breakouts in Forex.

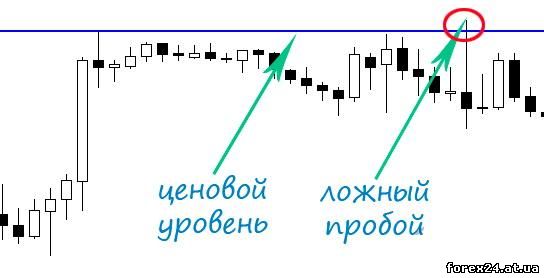

Please note that "puncture" is the signal for the transaction. The following illustration depicts the situation when the market reaches a resistance level which causes the opening position to buy, and then abruptly goes down.

The market is going down, and we still have an open transaction for the purchase, which will have to do something.

Ways to protect against false breakouts

To protect yourself in the course of trade from all the false breakouts, of course, impossible, but to make some measures to reduce their number we can. The easiest and most obvious method of protection is using in its work a small retreat. Its value depends on the timeframe on Forex that You are using.

As a rule, for such periods as M15 or M30, the deviation is about 5 points, and if you are on H1, then for currency pairs with high volatility can be taken and 10 points. The retreat is delayed from the level in the direction of the alleged penetration, as shown in the following picture:

Set the pending order Sell Stop if the deviation was calculated from the support level and a Buy Stop if you are working with resistance. This method of filtering helps to reject a large number of false breakouts in Forex.

As a rule, the price corresponding to the significant price level, or the beats and bounces, possibly with a small "puncture", or performs a quick overcoming of the level. In practice, the price rarely stops at the level value, to turn around, and is more common or "undershoot" in a few paragraphs, or "puncture", which is a few pips and then the market turns in the opposite direction.

The stop loss in case of false breakout of the level of

The idea provides a quick breakdown of the resistance level or fractal. This means that in the case when the price will "stagnate, we can talk about the false breakout. In such a situation the market has not enough forces that would be sent to the intended party, breaking the line, which we noted on the chart.

However, in such circumstances, it becomes easier to effectively cope with a stop-loss. Because when you open the position on the breakdown of deviations of the market in the opposite direction is already talking about a failed attempt to overcome the level, there is no reason to continue to watch the developments - the transaction has not justified itself.

When working on the breakdown, you should use short Stop loss, for example, 10-20 points, but a lot depends on the chosen trading instrument. If the market will breakout, we will receive profit, if the breakout is false, we will see a reversal of the market and our task is to get out with minimal losses. For this reason, the feet are short.

In other words, when opening the transaction, we understand, are we wrong. The choice is not great, only two options:

• if you were right, the price is rapidly moving in the right direction;

• if you do not are right, the price will start to push near the point of entry and will need to exit from positions that uses short foot.

It makes no sense to set large values for the stop loss, as by a false breakout in the Forex we already find themselves in an ambiguous situation, since the signal to overcome the level was not justified. If I were to summarize all that was said above, it is necessary to use padding and when to trade on a breakout to put a short foot.

|

| Category: Forex | Added by: (30.10.2017)

|

| Views: 736

| Rating: 0.0/0 |

|