|

Statistics

Total online: 1 Guests: 1 Users: 0

|

Trade

Analysis of the COT reports and their use in trade

For successful trading in the financial markets, it is very important to be able to analyze the situation and draw the right conclusions. As you know, the market is a one big organism, which develops according to certain laws. Knowing these laws, it is possible to accurately predict in which direction will move the price next.

To facilitate the process of studying of the market, traders can use elements of technical analysis or use the indicators. Fundamental analysis is also quite an effective method of predicting market.

Practitioners traders tend to use all of these tools at work, but not many people know about one more remarkable method of predicting price behavior - the COT report. This document is available weekly Commission CFTC, which monitors compliance with all rules of trading on the futures market.

All major market players are required to report to the CFTC, providing information about their open positions. Given that the COT reports are freely available, ordinary traders can use this information to understand where at the moment are "big money", which is known to "move" the market.

In this article we will talk about how to analyze the COT report and extract from it the necessary information.

Where to find the COT report

First you need to figure out where to find this document. All CFTC reports are on the website of the U.S. CFTC. Going to the menu item Market Report, you should choose a Commitments of Traders.

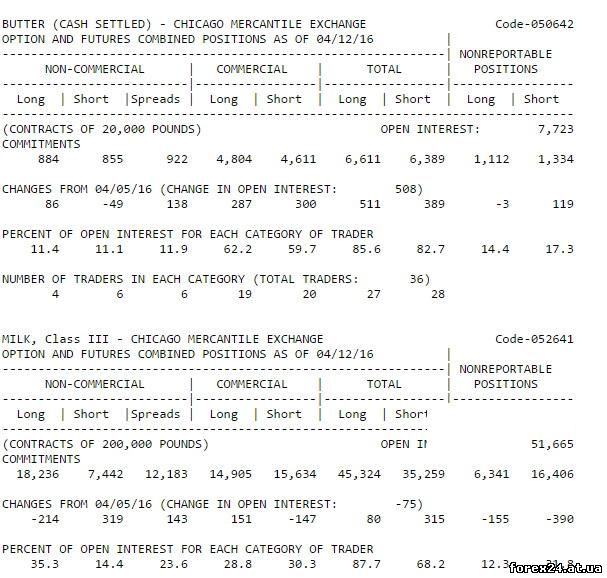

Flipping open down the page, you need to find a table of CURRENT, LEGACY REPORTS and in it Chicago Mercantile Exchange. The table consists of two columns for analysis you should choose the second one, where provides information about Futures and Otions Combined. In a short format information is as follows:

In the present report reflects the size of long and short positions of the players at the end of Tuesday of this week. That is, the data on the website are published with some delay since they updated on Friday. However, this does not detract from their importance. In the document you can see the information that applies to several types of market participants.

• Commercials it is a large hedgers and operators that significantly affect the economy. Company data (are often the producers of goods) are interested in how to profitably buy or sell goods. They seek to mitigate potential business risks that can significantly affect the price. Thus, these market participants tend to move in the selected direction.

• Non-Commercial represent the large speculators and traders who are usually banks and investment funds. The main objective of this part of the market participants to obtain as much profit as possible, based on the difference between the price of purchased and sold contracts. They also aim to continue the trend to obtain the greatest profit.

• Non reportable positions reflect the behavior of those speculators who use small amounts and do not have a significant effect on the market.

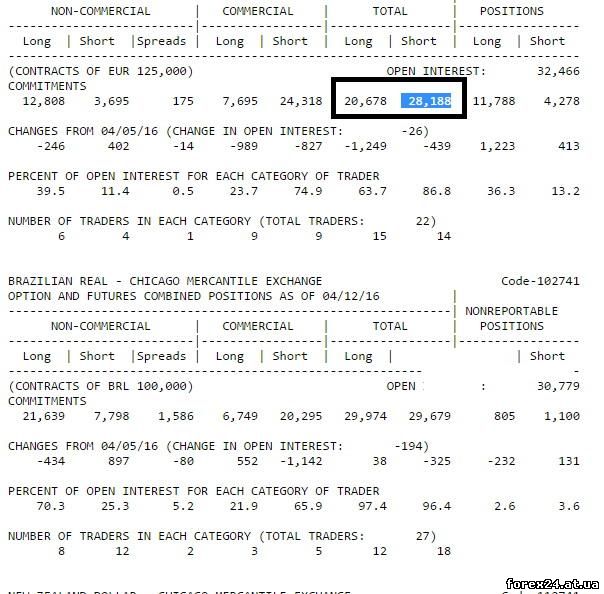

The report highlighted the column TOTAL, which are aggregated with the long (Long) and short (Short) positions of major market participants results. The document has information on both raw materials of various kinds traded on the market and about currency pairs. To discover them, you have to scroll the report down.

In the table for each type of product there is also a few lines that convey important information.

• COMMITMENTS reflect the number of currently open positions.

• Line Changes are shown as change of position in relation to the previous week.

• String Open Interest reflects the number of contracts that were not completed during the week. This figure is not of interest to the trader.

How to use the COT report to trade

Analysis of the COT report allows you to predict the future behavior of the trading instrument for the upcoming week. So COT can be used for trading in the Forex market and binary options trading. On what is based the analysis of the COT report?

Of course, traders are interested in the behavior of large players, so matter how long or short open positions in them at the moment. Since, as mentioned above, the Commercials and Non-Commercial seek to maintain the trend in order to get the maximum benefit, look to ensure that contracts are at present open more.

A large number of short contracts shows that in the near future the asset will fall in price and should be considered a sell or buy CALL options. Conversely, if the open contracts long, the price of the asset will rise.

It is worth saying that the use of the report of the WTO makes sense for the medium or long term trading. Many traders prefer to use the information provided in the report, in graphical form, which is much easier. You can use the special resources such as www.timingcharts.com. However, the ability to analyze the original reports is necessary for anyone who wants to really understand the market.

|

| Category: Forex | Added by: (30.10.2017)

|

| Views: 387

| Rating: 0.0/0 |

|