|

Statistics

Total online: 1 Guests: 1 Users: 0

|

Trade

Bill of exchange and Bank notes

Bill of exchange – security which is a written monetary obligation. The owner of the bill can exchange it for cash, the amount of which is clearly defined in itself a security, and sell or give it to anyone, without notifying the party who issued the bill. Obtaining amount is in a special place upon presentation of the securities. By the way, is the bill considered to be the first valuable paper, which appeared in the financial world. Think of it as debt deal or the obligation to redeem the document for a set in this amount.

The story notes

History of the bill is rooted in the Europe of the 16th century. Then ious began to gain popularity, and the holder could not transfer the securities to a third party. There are different situations when people resorted to writing receipts, but, in the end, in Bologna in 1569, it was decided to formalize bill system, the rules of which were recorded in a special Charter.

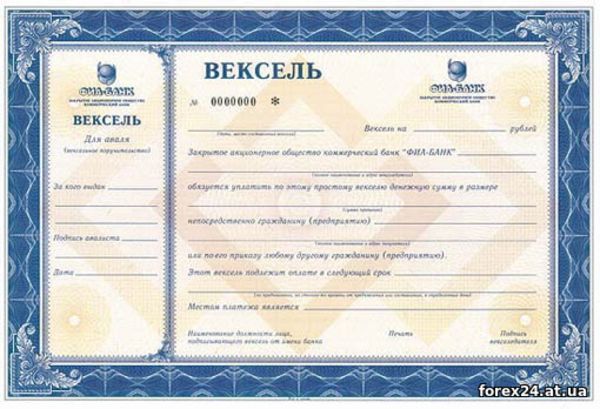

* example of a promissory note

In the 17th century, a turbulent trade relations began to dictate the rules of the stock paper. The bill was allowed to transfer to third parties, putting on paper a special mark, called an endorsement. In Russia, the promissory notes became popular only a century later, when trade relations with the European countries started to actively develop. Bill the Charter appeared in Russia in 1729.

In later centuries, articles of Association were rewritten, borrowing a lot of variants of France and Germany. Such changes were made in 1832, 1862, 1902. In the latest edition of 1902 there were 126 articles in the Charter. In detail the whole process of issuance, circulation, exchange bills. After the 1917 revolution, the bill circulation in the country decreased significantly. In 1922 bill reference again resumed, but it was allowed only banks and cooperatives.But in 1928, as a result of the new financial reform bill has been completely banned in the country.

Latest documents regulating the production, treatment, claims bills, were the laws of 1991 and 1997. All questions connected with the rules of registration of securities, interest and penny, in detail interpreted the Federal law № 48-FZ "About translation and the promissory note" dated March 11, 1997. This law still regulates all the process related to bill system.

Requirements for registration of bills of exchange

Obligatory requirements to the bill is:

• The document should be marked "Bill"

• The obligation to pay a certain amount

• The name of the parties, guarantees the payment of funds under the promissory note and the name of the party first received a bill

• The name of the payee

• The exact place where you can exchange the promissory note for the money and the trade deadline

• Place the bill, the date of issue and signature of the party that has issued securities

All of the above requirements are mandatory. If the document would not meet the conventional requirements, it may be considered invalid. There are some exceptions. For example, if the document does not specify the date of payment, the paper is subject to payment upon presentation. In the absence of the place of payment in the document, it is the address of the payer.

Promissory note - a simple turning and

a promissory note the obligation of the debtor to pay the listed amount. Terms of payment are on paper. A promissory note is playing the role of the debt receipts of the party that issued the document. The most usual situation is the release of the promissory notes is the process of selling any product. The buyer may not have money at the time of purchase of the product, and in this case, the buyer prepares the document, which is its obligation.

Bill – an indication of the party that has issued the securities, to pay document amount of money to the payee. Such an absolute order is given to the side of the payer specified in the document. In fact, in this situation, we see the transfer of the debt to a third party. Such a case could occur if people who apply for securities, has a certain amount of money to the holder of a bill, but it also has a debtor who assumes the role of payer.

In any case, the bill is issued in the same way. The sum can be written in words or numbers, but it is a text designation has priority. If the document is specified multiple of the amounts that is taken into account the least of them. In addition to the amount indicated on the paper document may include interest that has accrued on the cost of the bill. Interest for delay can be set in the document only if the bill has a settlement date.

Banking bill

the Banking bill is a financial instrument that can bring additional income to its owner. Money the holder of a bill is not simply stored in the Bank, but can be obtained at the first request. The yield of the notes not less than deposits, and often even higher. For the purchase of securities without having to open a special account, what I need to do in the case of a Deposit.

Can be called a Bank draft liquid financial instruments, has spread throughout the world. Securities may be considered not only as an investment option but also a convenient way of investing money, just not important enough for many people.

|

| Category: Forex | Added by: (06.11.2017)

|

| Views: 450

| Rating: 0.0/0 |

|