|

Statistics

Total online: 1 Guests: 1 Users: 0

|

Trade

The spread on Forex how to deal with it

Trading account on Forex with floating spread and became the most popular deposits of the currency market. The reasons for this are several, but one of the main brokerage companies actively advertise their trading conditions, promising spread from 0.2 pips. It is not strange, but many novices perceive information about "0,2 points" for the promise, but it's not.

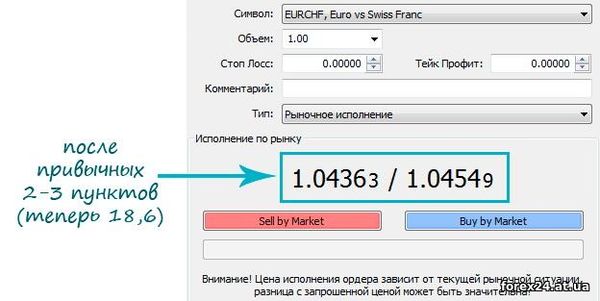

The spread is a temporary increase in the spread value, which can be very significant (the value can be increased ten times). When the company promises that the spread transaction will be from 0.2 pips, you need to understand what value You see in the terminal 2 times a day and only at nights with calm weather.

Next, I will talk about why almost all companies in the market broaden the spread, that this have and how to deal with it. Not all speculators notice how many lose money on such antics conscientious unscrupulous brokers and dealing centers.

Why Forex brokers broaden the spread

As usually happens in such situations, any company would immediately lead 100500 reasons justify the need to increase fees on Forex. After hearing them, the feeling that everything really clearly, and we the ignorant can doubt the best intentions of the organization through which trade.

List the most popular explanation of Forex companies to expand important for traders parameter:

• during the important news release may lack liquidity;

• at night (Moscow time) low liquidity;

• the market has shaken the balance of supply/demand and liquidity was not enough.

As you can see, all the troubles connected with the increase of the spread during trading, due to the lack of liquidity. Well, let's say, then why every other company "in all corners" States that has a connection to the different interbank systems that they are just swimming in liquidity, taking her all bathrooms and so on. Then, when it comes down to it, it turns out that she was sorely lacking.

The real measurement of spread - testing a few brokers.

Causes of widening of the spread as I see them:

• during important news releases traders easier to make money, and it's not like the companies specifically increase spread, "hung" terminals, and even openly prohibit trading news;

• night aktiviziruyutsya scalpers who bring much trouble to the companies that make the loss of money of its clients (that is, almost all companies in the market, read about the cuisine on Forex), but because it is necessary to increase Commission;

• once on the chart becomes visible sharp price momentum, companies are automatically pushing the spread value that customers are unable to earn a lot in such a convenient situation.

Catch and fight with spread widening

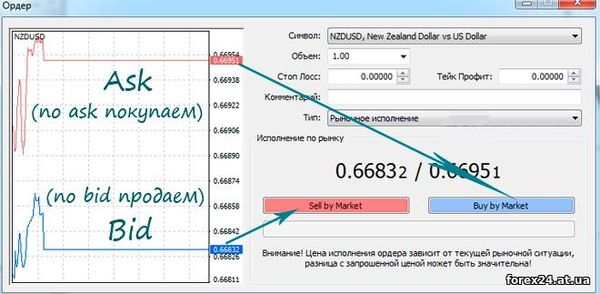

Sometimes it is more profitable to trade in the company with an average value of the spread than in DC, which may at any time increase "extortion" in 5-10 times. By the way, You same values as the closing of the transaction for sale (sell), you can safely stop, increasing the "Commission"? On the chart we see constantly the price bid (when you open the window for the transaction bid - the lower price, ask - upper), which are on sale.

AMarkets is the most stable version (not record small spread, but the extension is relatively small and rare).

If we put Take Profit order to close a position at market price (bid) will not be enough on the chart to reach the profit level. Price will have to fall below orders (bid, again I remind you) on the spread value, and now the drum roll.

If spread=2, then the market is enough to drop 2 points below the line for a successful closing of the transaction, but if you increase the value (no thief is not sitting in DC near the terminal, choosing Your trades, everything is done automatically - there is such a possibility in the admin MetaTrader 4), for example, up to 10 points, not the fact that the position is closed. It is possible that the price will go down by 5-7 points and let's grow, that is strength.

To notice something like that is not so easy, especially when you're not all the time near the terminal. You can use a free indicator that real-time measures of market spread, and then stores all values in graphical form:

Download this indicator for MetaTrader 4 free here:

Perhaps by providing the evidence of strange changes in market fees, You will be able to defend their point of view and the agreement is cancelled or will close at the average market value of the spread (depends on the company).

How to deal with the widening of the spread:

• to trade on accounts with a fixed spread (the execution Deposit will not Market, and Instant);

• to avoid news trading;

• to measure the value of "Commission" and if values are just too horse - to complain to the broker;

• choosing a company, to put on a real account indicator to measure of spread (a Deposit is not required, opening an account You no obligation).

Perhaps, more than anything, You really can not do. The most normal option that would not compromise, choose a company that is not engaged in the extensions or guides them rarely and in small ranges, for example, AMarkets.

If traders who are trading long-term agreements, loss in 2-8 PP doesn't matter much when the results of the operations hundreds of items for fans of intraday trading, and scalping such costs can be fatal. Perhaps these losses will cause the ultimate loss-making result.

|

| Category: Binary options | Added by: (07.11.2017)

|

| Views: 510

| Rating: 0.0/0 |

|