|

Statistics

Total online: 1 Guests: 1 Users: 0

|

Trade

Wave Bollinger in the Forex trading

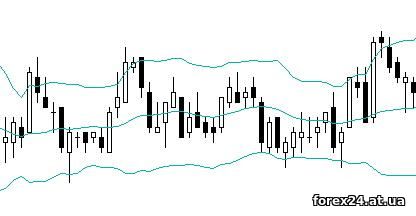

Wave Bollinger is a kind of price channels are often used for scalping in the financial markets. On the Forex in MetaTrader 4 once you have set the indicator Bollinger Bands (or just Bands), which automatically draws lines on the chart.

These builds also are called "Bollinger Bands", which can be considered synonymous with the waves. This is especially popular tool among traders who wish to trade rolling.

If you do not change any settings of the indicator and directly install it on the price chart, we can see three single line. Two of them are called outside of the channel, and the third received the name of the median line. For convenience, I recommend to change colors quickly to distinguish boundaries from the strip between them.

Remind these lines are moving averages? In fact, it is only the offset that allows the channel to move, as if on both sides of the market.

The Bollinger Bands indicator is most often used for trading in flat, and when the market is rising or falling quickly, the algorithm becomes practically useless.

The principle of trade on the waves Bollinger

This price channel is used in order to determine the optimal points of the transaction. A gradual shift to market prices is accompanied by a Bollinger band, but if there is a sharp jump, there is a puncture of the border, as shown below:

If the candle closes outside of the channel, how to place a trade in the opposite direction. Naturally, for the effective application of the algorithm to work on a sideways market, where there are no strong price movements up or down.

This method is often used by traders during the Asian session, when the probability of a flat is much higher than trend for a number of currency pairs. Every sharp movement of the market, that breaks one of the boundaries, becomes a signal for the transaction.

Now let's see how to get out of the position. Stop loss in this case is placed immediately after the opening of the transaction on a predetermined fixed distance that depends on the asset that we started to work. In any case, it must be a small quantity, about 7-15 points.

Take Profit when trading Bollinger bands it is recommended to divide into two equal parts. The first profit-taking occurs when price reaches the middle line of the indicator, and the second part of the deal closed when the market gets to the opposite side of the channel. If one part of the position is already closed and the market began to unfold to the price of the transaction, the second share is recommended to be closed, that is, on the market.

Do not try to use the waves Bollinger in the midst of trading sessions in Europe or the USA, when the probability and a long price movement up or down. In this case, the border program will break, but the price will not try to go back to the channel.

I recommend to pay attention to these two indicators:

• IVAR

• Trend Filter

This tool is well suited for scalpers, who will filtering work on time and will not make deals with the first currency pairs. First, wait until the market becomes a side and only then you can make a trade with Bollinger Bands.

|

| Category: Binary options | Added by: (07.11.2017)

|

| Views: 439

| Rating: 0.0/0 |

|