|

Statistics

Total online: 1 Guests: 1 Users: 0

|

Trade

Changeable source of income - Forex

Today, many speculators begin their career with Forex trading, so it is natural that all my victories and failures in the foreign exchange market, they are projecting the entire financial sector. And what to say, lately even the Federal media in connection with the adoption of the law on Forex dealers, and after the decline of the ruble, speculation in the foreign exchange market became one of the most discussed topics.

Unfortunately, many journalists use clichés and stamps, i.e. more scare newbies and not engaged in education. So today I will try to objectively tell progeria income in Forex, its variability, and will also touch upon the risks and challenges facing the novice speculator.

You should start with Novichkova errors, the most dangerous of which is the belief in the stability of the income, which is underpinned by the history of successful traders from all over the world. Let's deal.

I agree that professional speculators do live from the market, there are also those who only trades currency, so here is the truth, but the fact that the source of income, Forex and volatility – are inextricably linked concepts. Survive in the field of Finance, only those who have learned to manage risk and use probability. Look at the chart:

At point A trader needs to make a decision about buying or selling a currency pair. At first glance, everything is simple – on tutorial learn the news and make a bet on the strengthening of one currency relative to another, but in reality, many problems arise:

• neither the speculator does not know all the news, that is, until you read another publication in the press, in the World at this very moment there is something new, so after a few hours the market sentiment may change to the opposite;

• a regular trader knows nothing about the plans of the big players (banks, corporations, etc), so even the most logical prediction may not be justified;

• no one is immune from extreme events in recent years, currencies are very sensitive to geopolitics.

On the income of Forex, I recommend:

Video results for trade professional trader (there is a link to the method of trading)

Free SMS signals with long term statistics

The result of these factors, even experienced traders often make mistakes in forecasting. Once a position is open the price begins to go in the opposite direction, and the professionals from the novice in this case are distinguished by one feature – they put in stop-losses. Returning to the example:

Thus, if the price goes against an open position – the trader will receive a scheduled loss, so the variability of source of income Forex is not just natural, it is an integral part of the speculation.

The main task of the trader is to take the set of operations in General, plus absolutely no matter how will change the income, one month to 10%, next 20%, for the third to loss of 5%, it is all about annual income. If it is more than one percent on Bank deposits, trading strategy does not involve the constant presence of the monitor – it is possible to speak about achieving success in the Forex market.

Very different should be treated to trade intraday, in my own experience I can say that to achieve a stable result in this case is much simpler. This is because, as the above negative factors lose their influence, and every impulse, provoked by such news, intraday trader is perceived as a trend.

Volatility and profit in Forex

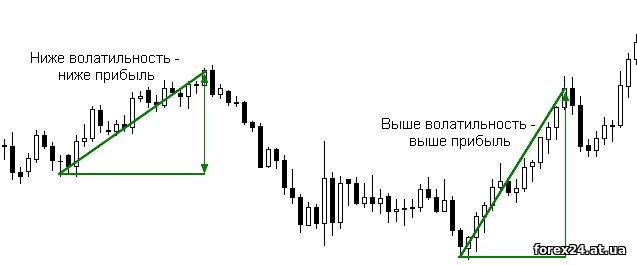

Source of income in Forex and its variability are often associated using the volatility characterizing the strength of fluctuations in the value of the asset.

In this case the dependence is of a twofold nature, on the one hand, the higher the volatility, the more you can earn:

But on the other hand if volatility is changing, many strategies cease to work, especially it is important to extend the range of fluctuations, partly for this reason, many traders leave the market.

And this is a logical step, because if the speculator worked for several years in a familiar framework, and here we have to adapt to the new environment, all that is necessary to count simply "not to lose", but on earnings it is better to think only after achieving stability. Not everyone can admit their mistakes and correct weaknesses.

Some traders work simpler – choose from all currency pairs only those instruments, the volatility of which meets the requirements of the strategy. Once expanded the range of fluctuations out a few from the working set, but I have a negative attitude to such systems for several reasons.

First for the source of the income on the Forex the volatility is a normal phenomenon, which just need to adapt. Some traders create a financial cushion in the event if the month is unprofitable, who does not only trading, but also other activities, in any case, extra insurance never hurt anyone (in short: do not burn the bridges for retreat, and everything will turn out).

Second if you stay in constant stress, constantly monitor the quotes, in the hope to improve the already good performance on the course, there is a chance to say goodbye to the market. You need to work in moderation, if it is negative, period – you can take a break from trading, after which with a clear head to have to think about the causes of the losses.

|

| Category: Forex | Added by: (06.11.2017)

|

| Views: 416

| Rating: 0.0/0 |

|