|

Statistics

Total online: 1 Guests: 1 Users: 0

|

Trade

Description of the indicator Gann HiLo and method of use

The indicator Gann HiLo is a another modification of the moving average, the first of which sought to minimize the time lag of the signal on trend reversal. It should be noted that they succeeded, because on the basis of this algorithm was even created several trading systems.

As you can already guess from the title, in the formula of this indicator are used in some calculations William Gann - one of the most mysterious people of the 20th century, as it is difficult to be simultaneously in one person, a religious figure, a Mason, a mathematician and a successful speculator (these are facts from his biography).

However, the development of Anna used in the financial markets today, and interest in his person fueled by rumors that William didn't tell about all your secrets. Perhaps that is why traders and programmers did not stop on already established techniques and are constantly in search of something new.

How looks configure, and it is the indicator Gann HiLo

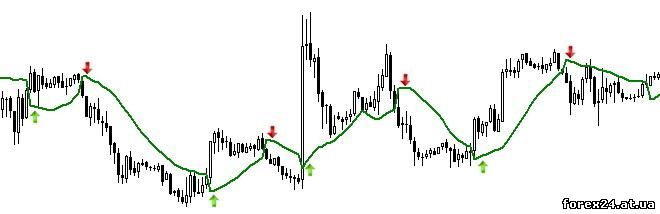

Externally, this algorithm is very similar to a normal Moving Average, but if the value of the last change smoothly, turns on the line Gann HiLo reminiscent of the zigzag.

This is due to the fact that the markup GH uses a filter on the closing price of the candle, that is, until the graph is above the main line of the indicator, it will only grow, but in the opposite case when type quotes are Close under GH, we can talk about a steady downward trend.

Configurable indicator Gann HiLo as simple as it looks, it is enough to optimize only one variable Lookback, a kind of analogue of the moving average period.

About the formulas underlying the algorithm, I can't give detailed comments, as this indicator is only available in ex4 format, but according to its author, not without the automatic construction of the "Gann". Let me remind you, this technical analysis tool is included in the standard set of terminal MetaTrader 4.

The use of the indicator Gann HiLo

Like any other algorithm of this kind, the GH can be applied in various trading strategies so today I will not focus on any one specific methodology; instead, they simply list the main signals that can be obtained using the indicator Gann HiLo.

The first signal, the most obvious, is associated with the identification of trends. To get it, need in the field Lookback ask a long period, for example, the following temporal graph GH constructed at 240 hours.

As with other trend indicators, it is necessary to find a balance between the quality of patterns and their delay.

The second signal many readers are also familiar and intuitive – we are talking about buying and selling currency pairs on a smaller timeframe at the time of the intersection line of the indicator Gann HiLo and price.

If you look at history, you notice false signals. To get rid of them does not work, so very often this approach traders combine with the methods of the first type, that is, first on the higher timeframe to determine dominant motion, and only then looking for entry points on the chart of the Junior order.

Two more interesting, in my opinion, indicator:

• ROC

• Forex Goiler

It should also be remembered that the breakdown on the layout of the Gann HiLo is confirmed after the signal candle has closed above the line, otherwise the pattern may be incorrect. This phenomenon is usually called repaint but I do not agree with this term, as the noise on the last bar for example.

The last type of signals the indicator Gann HiLo identical to the crossing of moving averages, that is, first on one chart there are two GH with different periods, then the trader waits for the formed in one of the following patterns:

the indicator line Junior order crossed the older layout from the bottom up – a buy signal;

if the value of Gann HiLo Junior closed below senior is a sell signal.

Of all these variants to use – everyone decides for himself, but, in my opinion, the best indicator Gann Hilo is suitable for long-term trends, but the patterns of the third class is too much late.

The advantages and disadvantages of the considered algorithm

If we were to examine the indicator Gann HiLo comprehensively, it is possible to identify these inherent strengths:

• it is elementary to set up, the trader is sufficient to specify only one parameter;

• marks on the history is not updated, so there is the possibility of optimization strategies in the previous quotes;

• the alerts themselves are also simple, as there are no stupid rules and limitations.

Without flaws there were, but they do not go beyond the usual framework, in particular:

• below the indicator Gann HiLo to catch a false signal, it is necessary to wait for the closing of the last candle;

• from time to time GH shows the entry point sooner than it should, i.e. it evaluates inclined noise.

|

| Category: Forex | Added by: (06.11.2017)

|

| Views: 635

| Rating: 0.0/0 |

|