|

Statistics

Total online: 1 Guests: 1 Users: 0

|

Trade

Economic events calendar. How to use economic calendar in trading?

Interestingly, regardless of the preferences in ways of trading, most currency speculators necessarily use in their trading the economic events calendar. For some, it is the main working tool on the market, others just check the schedule of events, that would not conclude the agreement right before the release of important news.

Various online publications publish their own version of economic calendar. The difference can be in the secondary events, which, as a rule, do not have a major impact on financial markets. Some organizations prefer not even to think about such things, others publish everything they can find.

Other differences are more relevant to the category of facilities use calendar. For example, if the event is as a result presenting to the public some numeric value (for example, the number of unemployed in the country), in some economic calendars is the preliminary figure announced last time.

This allows you to make predictions based on history and new factors that can affect the numbers.

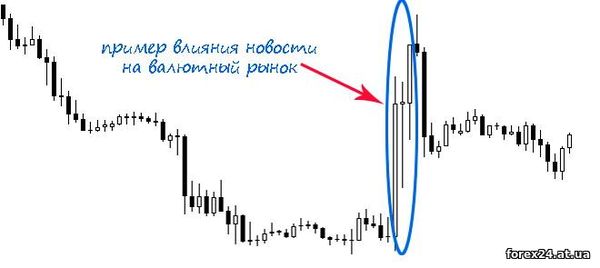

Many calendars also contain clues that may appear in the form of bovine heads, stars and so on. Most will be at the event, considered very important for financial markets. The announcement of such news can dramatically stir up the market.

How to use economic calendar

If the trader uses the news factor in their work on the market, the viewing events in the economic calendar for the day will be required at least in order to open a position right before the announcement of important information. Otherwise, the speculator risks to make a deal that immediately after the announcement of news will become irrelevant.

There are ways to use the calendar of events in their speculative purposes. In this case, the trader tries to predict what data will be expected by the market. The second option consists in the careful assessment of what happens to the market immediately after the news release.

To predict what exactly would the new data, as well as the response of the market very difficult. Exactly what this task is not for the beginner, so it is better to choose one of the other options. It is easier to act when we see what the market reaction to the event of the economic calendar. In this case, the trade looks very simple.

A few minutes before the release of important news at a distance of 2-15 pips from the market price set two pending orders - buy stop and sell stop. If the information is not much different from market expectations, then there is no particular reaction, we will not see. If the declared data was significantly better or worse than the opposite of expectations, then the market price begins to dramatically rise or fall.

Assume that the market did not react to the information. In this case, the trader simply deletes pending orders after a while, when it becomes clear that is pointless to wait for a sharp price movement. In the case when the price breaks the market and opens a trade, the second pending order, you can safely delete.

There are numerous other ways to trade the economic calendar of important events, but the basic principle is either to the market reaction to the news, or the avoidance of trade during the release of significant information. In any case, the calendar is taken into account when making decisions, even if not the primary way of finding points of entry into the market.

|

| Category: Forex | Added by: (06.11.2017)

|

| Views: 491

| Rating: 0.0/0 |

|