|

Statistics

Total online: 7 Guests: 7 Users: 0

|

Trade

Fibonacci fan - use the fan on the Forex

The Fibonacci numbers are well known, probably even to schoolchildren. Around a sequence of numbers spinning different assumptions, theories which find application in a variety of Sciences. Forex market is closely linked with mathematics and probabilities, could not ignore Fibonacci.

Today we will see how to construct a Fibonacci fan on the chart, how it is used in the trade and understand how traders create based on this building a trading system. So I recommend to read the article, the Fibonacci Spiral.

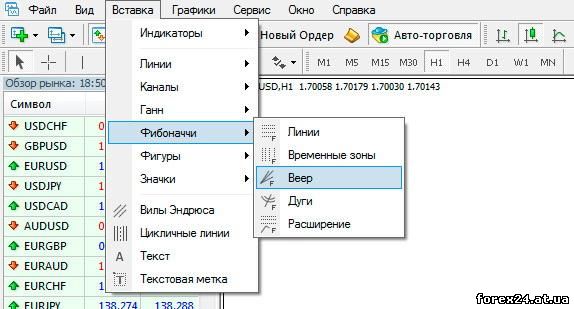

It is very convenient that the MetaTrader 4 is very easy to create a Fibonacci fan, which includes the three beams. In the program settings if desired, you can put additional rays, but more on that later. For choice build in the terminal just press "Insert" select "Fibonacci" and then select "Fan".

Next, determine the trend of the graph is completed, namely, its minimum and maximum prices. For example, take the usual market situation, where we denote the point 1 the lower extremum, and point 2 of the upper extremum.

Selecting in the terminal program, we first click on the point from where began the trend (in this example point 1) and then pressing the mouse button, move the cursor to the second extremum (point 2). When the button is released, we will see that between 1 and 2 now have a dotted line, and on the chart there are three beams: the 38.2, 50 and the 61.8.

The rays of the fan with properties similar to the levels of support and resistance, but they are inclined. If you set the indicator to expose the construction of four beams, that will appear on the chart another line of 76.4.

Recommended brokers:

• Alpari is one of the best brokers

• Maxiforex - free Forex SMS signals to clients (a cool option for beginners)

• AForex - balanced company, a good choice

If the trend is still continued and has been updated extremum, for example, the upper, as in our example, you should rebuild the fan with the new data.

How to use Fibonacci fan?

Lines represent price levels, and this means that overcoming them price is often fraught with difficulties. The break of the 38.2 of the beam more gives us to understand that we need to attend to the situation. From this level, rare fender price, in contrast to his roommate - 50. When the market reaches a level of 50 should be ready for the opening of the transaction.

The position is opened all the time in the direction of the development of the rays, i.e., in our case up. The operation involves one of two scenarios:

1. the price broke through the level 50 downwards and then it began to grow. At its intersection of the beam 50 upward opening the deal to buy.

2. the price breaks the 50 and almost reaches the beam of 61.8. When you approach the market to this level opens a buy position.

Any construction of Fibonacci is commonly used in conjunction with other trading methods. Using, for example, only one fan can possibly be achieved in full. In terms of the choice of method of fixation of profit by traders have complete freedom of action. If you talk about the location of the Stop Loss, it is recommended to place under the beam of 61.8. Because the lines are constantly growing, at least in this case, then the Stop loss periodically slightly increase after the beam.

Still recommend these materials, close on the subject:

The Keltner channel is an interesting variant of the price channel

Support and resistance - the famous way of defining and using price levels

The pin bar is a rare, but reliable reversal pattern

For situations, when analysing the downward trend, everything happens on the same principle, but is mirrored (on the contrary). Below You can see an illustration of the Fibonacci fan for a downward market trend.

It is seen that the situation is similar, only everything turns upside down. The first point fans will have the upper extremum, which we are in the dotted line to the minimum value of the price. All transactions in this case will be for sale, and the break of the 61.8 beam will signal the changing market trends.

By the way, the strengthening of prices for ray 61,8 gives reason to consider everything that happens not as a temporary market correction, but as a complete reversal.

Some traders prefer to use a 4 beam, adding an additional line, as an extreme instance when solving a problem that is observed in the graph, a correction or a reversal? Actually, when the break beam 76,4 we are, unfortunately, too late to categorize the price movement as a full-fledged reversal.

What you can use Fibonacci fan?

Of course, to combine the fan can classic price levels support and resistance. The break of the first beam and the return rates on the chart are forming a local extremum, which can hold the support level, as in the example below.

In the future, if the price again tries to go down, punching the rays of the 38.2 and 50, we are going to have a rough guide how much will probably be fall. The illustration shows that the market is again down to the support near by some time fluctuations and then price rising again. Just at this level marked on the graph by the blue line, it's worth signing a deal to buy.

As mentioned above, the Fibonacci fan represents price levels, but only obliquely. Combining this construction with the classical levels of support and resistance will allow you to more accurately determine the market situation.

Note how clearly the price hit the 61.8 beam, which is the most powerful obstacle to the market and then bounced back up. If the market managed to gain a foothold below the level of 61.8, the trader should analyze the chart from the point of view of a trend reversal and take appropriate action.

Fibonacci fan allows to systematize the work with the trend, using the price adjustment. This approach to trading gives you the opportunity to imagine where will be held the end of correction. If you are having trouble with levels 50 and 61.8 to enter into agreements, as a rule, positions that are open at very good prices.

|

| Category: Forex | Added by: (05.11.2017)

|

| Views: 409

| Rating: 0.0/0 |

|