|

Statistics

Total online: 1 Guests: 1 Users: 0

|

Trade

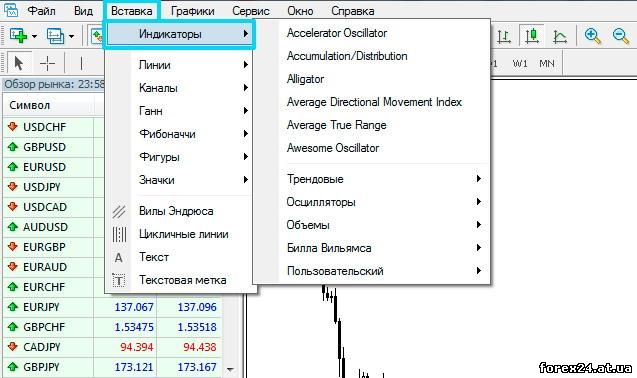

Forex indicators

What are indicators in Forex trading? This is a mathematical transformation of price, which helps to obtain necessary information about the market situation in the form in which you want. The data that are on the market can be represented in the form of price and time. But such a view is not very convenient for human analysis, for decision-making on the exchange. Tasks can be different, and therefore, based on the needs, to create a particular indicator for selected mathematical formulas converts the data coming from the market, in the form preferred by the trader.

The indicator on the Forex trading can serve as an analytical tool, and to select points of entry into the market or out of it. In fact, there are many varieties of indicators that are classified. The same famous Moving Average can serve as long as the determinant of the direction of the trend.

At the same time, some speculators use this program to open and close trades, trading "breakdown" of the middle line, or Vice versa "on the rebound" from the middle line. It turns out that there are indicators from the narrow list of tasks, but there are others that can absolutely be used in the work.

Data for indicators Forex

For a variety of calculations, needed for the indicators, as a rule, use Open, High, Low and Close prices for certain time intervals. The data is taken not only of this time but are used for calculations the formula are substituted in the values of the past. Thus, the speculator, setting the schedule of the program, and immediately gets the opportunity to observe not only its behavior in real time, but also see his testimony on the historical quotations.

Analytical indicators on one chart to show the direction of trends for different trading instruments, to calculate the probability of continuation of price movement and so on. However, they in no way give advice that the person needs to do in a given time.

Rather, one can evaluate the received information and on its basis to make decisions. Trading indicators on the contrary are intended to signal the speculator a good market situation for open positions. Typically, these programs already demonstrate the principle of trading, which was selected by the human for its work. Alarms can be both visual and audible.

As mentioned above, all data for calculations are taken from history or accepted online. This means that the program takes into account only what was on the market and what is happening at the moment. Hence, we can conclude that the indicators are not suitable to predict the behavior of prices in the future.

From the point of view of technical analysis in the market everything is cyclical, but not to such an extent to obtain high probability of correct signal based on the quotes of the past. Besides, only one signal to open a position in any case is not enough. Important role in trade played by the method of position tracking than the indicators usually do not do.

Signals

That may be a signal to open the transaction on indicators? For example, we choose to graph the middle two curves with different periods. Thus, one of the curves will be more sensitive to price changes, the other more "roughened". We decide that once the "smart" curve crosses its neighbor bottom-up, time to buy a trading instrument, and when the intersection occurs from the top down, then there is a sale.

As a result, the trader will not make deals until then, until the intersection curves. Such actions may be those signals trading strategies that are practiced currency speculators.

It is understood that a Forex indicator can not predict what will happen in the market in the future. It can only show what it was before. Thoughts and ideas about trading people can already make decisions, taking into account indicators of their electronic assistants. Imposing on them an impossible task in determining the market of the future, the trader admits serious mistake.

|

| Category: Forex | Added by: (05.11.2017)

|

| Views: 1230

| Rating: 0.0/0 |

|