|

Statistics

Total online: 1 Guests: 1 Users: 0

|

Trade

Instant Execution or precise execution

Instant Execution this is the exact execution of the trading order. It is clarified that the triple speed of processing the application trader is the literal translation, but more often it is accepted to speak about the exact execution of the order. This means that currency speculator can expect to buy or sell a specific amount of the trading instrument at the price which he sees in the moment of pressing the button.

When using Instant broker is almost completely free from slippage. As a rule, accounts with Instant Execution is offered with four decimal places.

To understand the principle of execution of orders of clients for Instant let us consider an example. A trader is watching the market and at some time decides to buy one lot of EUR/USD currency pair at current price of 1.3455. The company receives the application and processes, trying to buy the market one lot on the rate chosen by the customer. If, at the time of the transaction, the market price has changed, it is likely that a trader will be sent information – requotes.

The second method of processing orders is Market Execution.

As a rule, better than was indicated by the scalper price, the deal will not open. The trader will be asked to try again, but with the current market price. This happens in the case if from the date of dispatch by the trader, the order of the conclusion of the transaction and prior to processing this order of change in the market price.

The precision of execution is often important to merchants, for whom even spent an extra item when opening a position is of great importance. As a rule, scalpers prefer Instant Execution because the execution method has a high accuracy. If the price will change rapidly and the broker will no longer be able to make a deal at the client is requesting of course, it will not open a position at current market price without approval by the trader.

In this regard, if you can't buy or sell trading tool for as much as I wanted the speculator, he / she will receive an appropriate message. The company immediately offers to its customer the current price at which people can agree or disagree. In this situation the scalpers, seeing that it was not possible to open a position that interests them the price, just refuse from the agreement at the new market rate, is not beneficial for them.

The advantages and disadvantages of Instant Execution

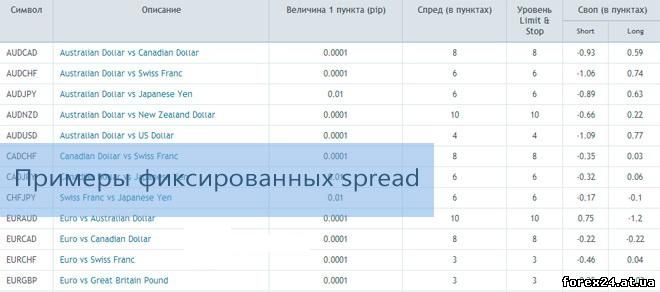

Spread the Instant, is usually a fixed amount. With the size of the spread can be found not only with trading company accounts, but logging on to the website of the broker. In contrast to Market Execution, people will be able to find out, how big is the spread on each trade.

In most cases, fixed values exceed the size of the floating spreads on different account types. Opening the position, the trader will immediately calculate how much the items will go to pay for the services of the brokerage company.

The need for Instant Execution exists today. Not only novice speculators choose this form of execution. Among users might be found and experienced traders, for which the accuracy of position opening is a priority. Of the benefits Instant Execution include:

• accurate opening positions by a specific trader price

• fixed spread values, which wouldn't surprise

Companies that offer accounts with Instant execution order:

• Roboforex

• Instaforex

• Liteforex

In recent years, Instant Execution become less popular than Market Execution. Mostly accurate execution of use novice traders who do not understand all of the pros and cons of different treatment options order. Hearing about the accuracy, newbie appreciates this advantage, which sometimes becomes a decisive factor when choosing a trading account. Also, among fans of fixed spreads and projected prices of opened positions are scalpers.

At the same time, more experienced currency speculators question, what to choose, Instant Execution or Market Execution, is not worth it. Most experienced traders still inclined to the latter option, as no re-quotes and a small value spread traders are valued much higher.

|

| Category: Forex | Added by: (05.11.2017)

|

| Views: 410

| Rating: 0.0/0 |

|