|

Statistics

Total online: 1 Guests: 1 Users: 0

|

Trade

Market Execution and interbank quotations

Market Execution is the execution of transactions at the market price. At first glance it may seem that the market price can only be, but under the wording lies a certain sense, which distinguishes this type of processing of the request of the trader from Instant Execution.

The fact that the choice of the method of processing orders currency speculator much depends on accuracy, as well as the fee that must be paid to the client company. The interbank market has quotes with five decimal places, that speaks to the high accuracy of quotes.

In addition, the trader will forget what re-quotes when working on an account with Market Execution.

To tell everything in order, you first need to understand the broker offering its customers the method of execution of Market Execution. From a speculator enters an order to buy, for example, one lot of EUR/USD. The company accepts the application and immediately make the purchase of the lot the client's currency pair. Market prices change instantly, so count on that at the moment of pressing the button "BUY" trader price will be exactly the same as at the time of conclusion of the transaction on the market, is not necessary.

The position can be opened like a better price than was indicated in their application entities and less favorable for him. It all depends on the value that was present in the market at the time of actual purchase. Broker does not issue in the client terminal information that the given price is impossible to buy one lot of EUR/USD, but simply making a purchase at the current market value. This is the reason for the lack of requotes.

In the foreign exchange market, some prices can even "proglatavetsa". For example, transactions are 1.34555, then 1.34556, but in the case of applications for 1.34557, the transaction will be concluded at this price. Such phenomena are called gaps, and so is the explanation of the lack of precise execution order of the trader. For this reason, possible no slippage even when used to trade pending orders.

The strengths and weaknesses of Market Execution

Spread while Market Execution is floating, that is, changing its meaning depending on market liquidity. Typically, each instrument has a certain corridor of values for spread.

The negative side of the AC spread is the inability to predict its magnitude at the time of the transaction. But there is one positive point in a changing spread, it is less important than when working on accounts with a fixed spread. Rare to see a widening of the spread to such quantities that he was more of a fixed value when you work with Instant Execution.

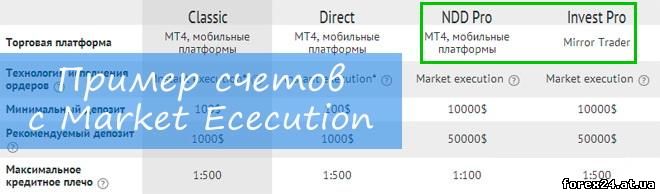

Brokerage companies usually offer various account types for its clients, some of which use the technology of Instant Execution, Market Execution and others. It is impossible to refuse all the market from one of the two variants of execution of the orders, as they have their advantages and disadvantages. Every trader uses the mechanism of processing the application that best suits his trade.

The main advantages of Market Execution can be considered:

• accurate quotes with five decimal places

• no re - quotes- the agreement with the sending of the order will still be lies

• smaller values of the spread (in most cases)

• some companies the best conditions for placing orders near market prices in the accounts Market Execution

Disadvantages Market execution:

• no precision in the execution of orders

• present the slip

• spread occasionally may exceed the fixed values of accounts with Instant Execution

Brokers that have accounts with the method of execution Market Execution:

• MaxiMarkets

• Alpari

• FXopen

• AForex

To whom it may be inconvenient to trade with Market Execution? First, it is the scalpers, because they have to account for every item. For them it is desirable to know in advance what the value will be spread in each transaction. Secondly, who needs to conclude the transaction strictly at a certain price, that is, slippage is not permitted. Such speculators is likely to opt for Instant Execution.

|

| Category: Forex | Added by: (05.11.2017)

|

| Views: 450

| Rating: 0.0/0 |

|