|

Statistics

Total online: 1 Guests: 1 Users: 0

|

Trade

Pattern a doji on the Forex market

In the foreign exchange market a lot of speculators use a variety of patterns, as a rule, belong to the Price Action. Candlestick analysis is very popular among experienced traders, but because some of his patterns is in demand among various groups of traders in Forex. Suffice it to recall a pattern pin-bar, which we had been previously told, but today a review of another popular graphical model.

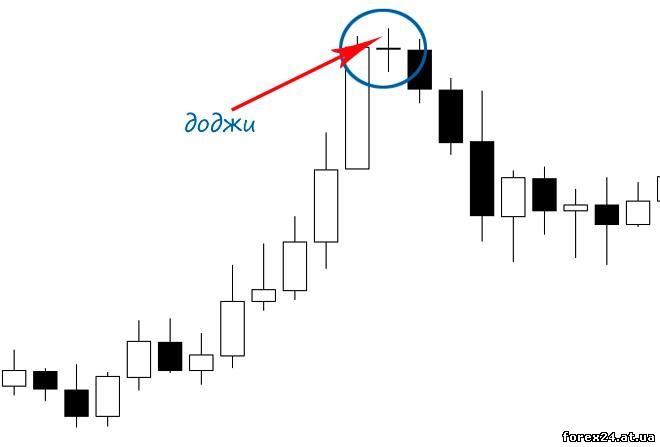

Pattern doji (doji) candle "without a body" when the opening price is almost identical (or completely) the closing price. Another important distinguishing feature of the classical model of doji is the satisfaction of both the shadows of.

When there is a formation of shapes doji? Of course, in a flat of such candles is not enough, but there we are unlikely what can help in trading. If we see this pattern in the day time (European or American session), he gave us quite useful.

For market analysis we first need to define the timeframe (TF), which will study the situation and to trade. If you plan, for example, to work with M15, then search doji needs to be on the same TF.

The use of doji in Forex trading

So, TF we for his trade picked up, and now turn our attention to the conditions that must be met in the market that we could make a deal. For a start, wait, when on the chart will reflect the market trend that will become a signal "attention".

Just before the formation of the doji needs to be "pulsed" candle that has a "great body" as in the figure below. If on the chart we see a similar situation, you need to prepare for the conclusion of transactions for sale.

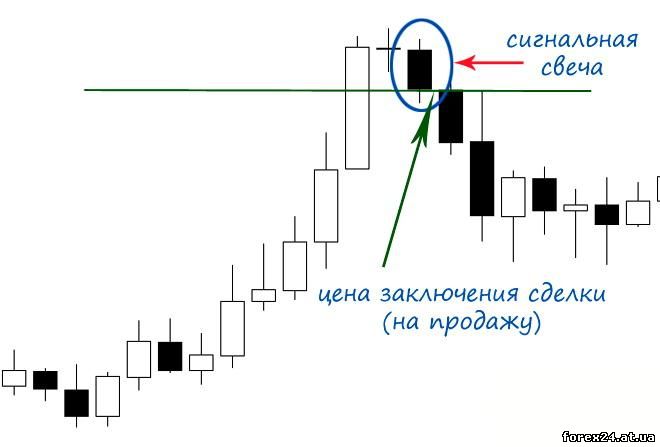

After forming a doji on Forex next candle ("signal") should be closed in the opposite direction to "pulse candle". If the market trend doji was growing, the "signal candle" closing price must be below the opening price for signal to open position.

As soon as the "signal candle" closes, satisfying the conditions for the use of the pattern, we can immediately conclude the transaction, as shown in the illustration above. If on a graph the downward trend of the currency pair, after formation of the pattern of the "signal candle" it is directed upwards (closing price above opening price).

Doji-gravestone - a variant of the popular pattern

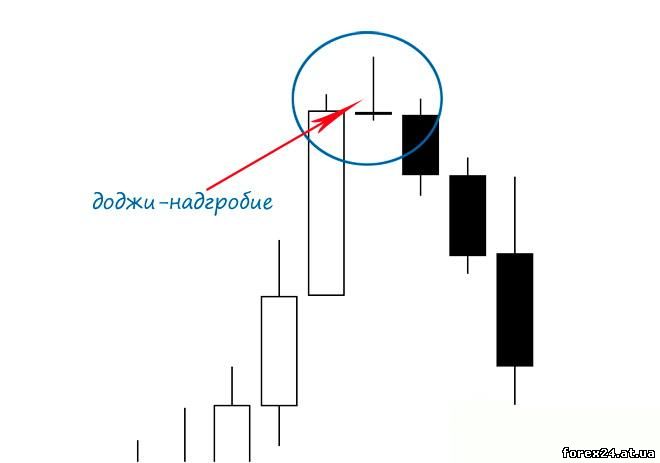

There are several varieties of doji pattern, one of which we now consider in more detail. Model name creepy - doji-gravestone (grave), but this option is one of the most reliable ways to determine the change in market trends without any serious lag.

The difference with the previous model lies in the size of the candle. It is only about growing market when the doji gravestone "unfolds" quotes down. In this case, the lower shadow of a candle must either be completely absent or be of the minimum size is clearly inferior to the upper shadow.

Reverse Forex model called "grandma", don't ask me what for violent fantasy was involved in the invention of all these names. In this case, the Dodge will be minimal upper shadow, and lower, as You may have guessed, is quite significant.

Forex doji is a reversal pattern, "wrapped" in a few simple rules for transactions. This is a stable pattern, which for many years used by speculators to find reversal points. Of course, it makes no sense to sit at a terminal and wait, when will appear it is this figure, and still met the conditions for pulse and signal candles. Better to just add this kind of agreements in your trading portfolio, which can and should be other patterns, for example.

Let the signals at the conclusion of the transaction will not be very frequent, but reliable. Having in your trading portfolio 2-4 tested the pattern, you can get very good profit from trading. In addition, in my work, you can use multiple instruments (currency pairs, for example), which will increase the number of signals, and therefore agreements.

|

| Category: Forex | Added by: (30.10.2017)

|

| Views: 836

| Rating: 0.0/0 |

|