|

Statistics

Total online: 1 Guests: 1 Users: 0

|

Trade

Pattern of the Dragon: a graphical model and trading strategy

Estimated pricing model (pattern), known under the name "Dragon" is one of quite common in financial markets chart patterns that gives the chance stuffed his hand in the graphical analysis traders to build and develop a profitable and safe trading strategies.

Changing trends in the Forex market usually takes place with the formation of a series of specific price movements and test the current levels of support and resistance.

Characterizes the change of the trend pattern of "Dragon" can be found in almost all time intervals (rarely on the daily and weekly charts, often on the intraday). The basis of this graphical model - pivots give good signals for market entry.

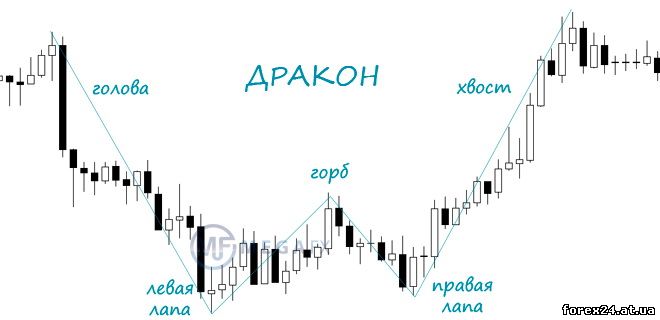

The graphical model of the Dragon

Visually, this pattern is very similar with the pattern "double bottom/double top" (analogous to the patterns M and W, "Dragon" can be normal and inverted), and it is formed generally in the area of price days. Similar and purpose of using patterns is getting a signal to open trades with a good ratio of potential profit and level of risk.

The component parts of the pattern in the order of their formation:

• "Chairman";

• "1st foot" (left);

• "the hump";

• "2nd paw" (right);

• distance, which is the opening price of the position to the target, called the "tail."

The formation of the pattern always begins with "head", "legs" may differ from each other by 5-10%. The trend line held the "head" and "hump", which can be considered as oscillation maximum between "dragon".

The signal for reversal of the market formed the second gives "paw", a confirmation of the reversal a noticeable change in the volume of transactions.

The pattern analysis should continue only if the trend line is well visualized.

After the chart showed the contours of the "Dragon", comes the breakdown of the formed trend line (actually a graphical confirmation of the reversal), which is the signal for the opening of trading positions.

Varieties of the pattern:

• "bullish" model - usual "Dragon", generates a signal to buy

• "bearish" model - inverted "Dragon", generates a sell signal.

"Dragon" trading strategy

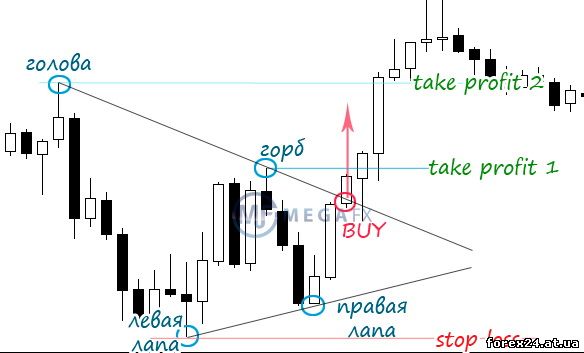

Trading rules for both models of the "Dragon" mirror, so it is enough to consider only the normal pattern.

Classic trading:

• Build line "head-shoulders" (trend line);

• In the breakdown are included in the market;

• To minimize the risk of erroneous input should wait for full candle close above this trend line;

• The target level of the transaction, high "Chairman";

• Stop-loss below the level of the "lower legs".

More rational is considered to be a partial closure of the transaction in the course of trade or the operation of the two orders, move stop loss after the new take-profit (the first profit - taking- maximum "hump").

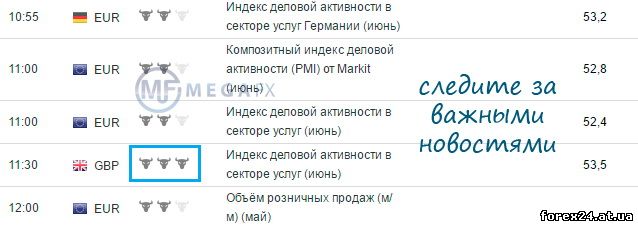

It is important to implement the strategy: well-formed pattern of "Dragon" can be instantly destroyed on the background of important economic news for Forex (of their appearance can be read here).

To improve the reliability of identifying key points in the trade pattern, it is desirable to add additional technical indicators, ideally the oscillators (RSI, MACD, Stochastic, etc.).

To implement the strategy, it is recommended to select a currency pair with low spread. Check the operation pattern, "Dragon" in the global broker Tickmill, where the spreads start from 0.0 pips.

An alternative variant of the above algorithm is the division of a model "Dragon" pattern "Double top" and a normal trend line.

|

| Category: Forex | Added by: (30.10.2017)

|

| Views: 421

| Rating: 0.0/0 |

|