|

Statistics

Total online: 1 Guests: 1 Users: 0

|

Trade

Pearson Correlation

Pearson correlation, also called linear correlation, is used primarily to eliminate the lack of covariance. To establish a direct link between the variables and their absolute values it became possible thanks to the linear correlation analysis. Pearson correlation coefficient allows you to set the closeness of the relationships between the features. If the relationship between variables is linear, the Pearson correlation coefficient determines the strength of links with high accuracy. Pearson correlation assumes that the two considered variables measured at least on an interval scale.

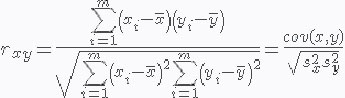

The Pearson correlation coefficient is calculated by the formula:

To apply the Pearson correlation coefficient, it is necessary to observe following conditions:

• Considered variables need to be acquired in ratio or interval scale

• Distribution of variables X and Y should be close to normal

• The number of varying features of the variable X must match the number of varying features of the variable Y

The Pearson correlation coefficient characterizes the existence of a linear relationship between two variables.

|

| Category: Forex | Added by: (05.11.2017)

|

| Views: 410

| Rating: 0.0/0 |

|