|

Statistics

Total online: 1 Guests: 1 Users: 0

|

Trade

Point on Forex

The paragraph on Forex – unit of changes in market prices. As synonyms the item used PIP and a point. That is the minimum value that the price can vary, there is a PIP.

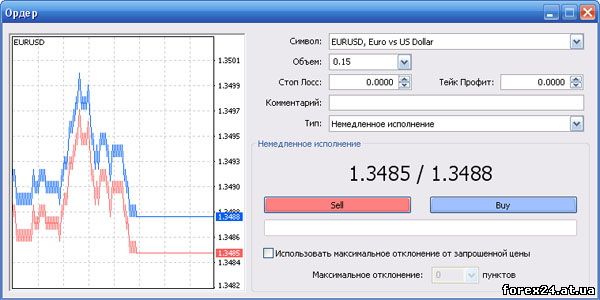

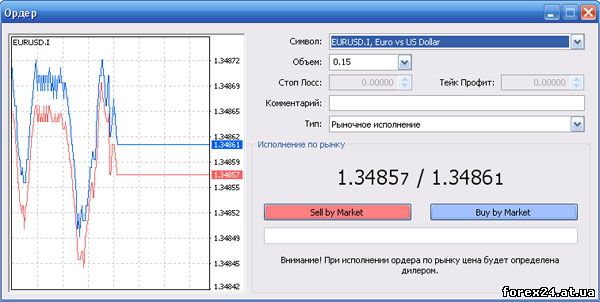

The significance of the items may be different depending on the number of digits of a particular company. Consider the situation on the example of the EUR/USD currency pair:

• One brokerage company can broadcast the quotes with the four characters after the decimal point, for example, the price of the currency pair will be 1.3540. In this case, the price can change at least 1 point, i.e. 0.0001. As a result of change quotes one PIP, the market price will be equal to 1.3541, if there is growth or 1.3539, if there is a decline.

• First brokerage company to provide customers with quotes with five decimal places. Suppose that the value of the market price of the same currency pair EUR/USD 1.35402. As we can see, the value of price added another figure, the example above, which suggests a more accurate quote than in the first case.

In the second example, the minimum change in market prices would not be 0.0001, and 0.00001. In this case, the item assumes a value ten times smaller than in the first embodiment. Therefore, when traders communicate with each other, they said, about where it is.

Why do you need different items? Much depends on the preferences of most brokerage companies, in what form to submit quotes to clients. Previously, more common were the bills with four digits after the decimal point, then the company began to move in a more accurate way of quotes, which is primarily appreciated scalpers. Traders, which, in turn, value each PIP, appreciate accurate quotes.

The value of one PIP on Forex

Under the PIP value in Forex is considered to be the change funds account, which will occur when the value of the market price by one point. For example, if you trade on the currency pair EUR/USD the market price will change by one point when you open trade 1 lot, the value of the account will change to $ 10.

Why $ 10 and not some other value? Here it is necessary to remember that 1 lot of EUR/USD currency pair is 100,000 of base currency, ie dollars. The base currency is always second place to the name pair such as USD/CHF it will be Swiss franc (CHF).

Change one item, the change in quotes 0.0001, if we are talking about four decimal places. Is 100,000*0.0001=10. Each passed the agreement item (EUR/USD) with a lot of = 1, will cost $ 10. If the transaction is concluded to the volume of 0.1 lot, that is one Forex point change means account 1 dollar (of 10,000*0.0001=1).

The PIP value of USD/CHF

As you can see from the title of the section in a currency pair the base currency is CHF. Suppose that the market price of USD/CHF at the moment 1.2000. Here it is necessary to understand that the rate at the moment is the following: 10.000 USD = 12.000 CHF. If for this value we bought 0.1 lot (of 10,000 of the base currency), and the market will raise the price of the pair up to 1.2001, we can say that we have earned one franc. While 10,000 USD will now be equal to CHF 12.001.

The balance of our Deposit in US dollars, so we need to understand how much money will be added to our account? For this it is necessary to transfer earned franc to the currency of our account. Profit, we divide by the current rate, it will look like the following: 1/1.2001=0.83 usd. As we can see, unlike the EUR/USD pair one PIP of USD/CHF is smaller, namely 0,83 usd vs 1 usd.

From calculations it should be clear that the value of one PIP varies depending on the value of a currency pair. Try to substitute in the example discussed above, not 1.2000 and 1.3000. Thus, it is worth considering that the cost of one item in different currency pairs can be different.

|

| Category: Forex | Added by: (05.11.2017)

|

| Views: 390

| Rating: 0.0/0 |

|