|

Statistics

Total online: 1 Guests: 1 Users: 0

|

Trade

Pyramiding in Forex

The name of the method is pyramiding, is an automatic Association with a certain consistency, consistency. Feature of pyramid is that at the top it is something small that increases to the base. Of course, talking about the trading methodology is difficult to conduct such a direct Association, but in this case for good reason.

Pyramiding is a trading technique in the process of which there is a gradual increase in trading volume. Thus, in contrast to averaging, the increase intended to get out of the slump, but rather to increase sales of profitable positions. How it looks in some cases, pyramiding, we will consider below.

Hesitation or caution?

It is reasonable to wonder why do I need to add items when you can just open a trade need lot? To answer this question, we should first discuss why the use of pyramiding. The fact that the trader may not know exactly where the price will go, and has the ability to only speculate about it, based on some thoughts.

To open a trade in big lot is dangerous and will generally be a violation of the risk system used to trade. Another thing, if you first open one trade for a small amount, then waiting until some profit on position, are earned "safety cushion", and to make another trade in the same direction as the first.

When trading with the use of pyramiding, the trader decides how many positions will be open until the moment you close them all, making a profit. Speculator in advance decides how much to open new trades, because they can be implemented by the same lot, as when you open the first position, and it is possible each time to increase the volume of purchase/sale.

The principle that a decision will be made about opening new trades, as well considering the person in advance, according to his trading system. Remains unchanged in pyramiding one is the increase in the total volume when the price moves in the direction of profit.

Pyramiding and price reversal

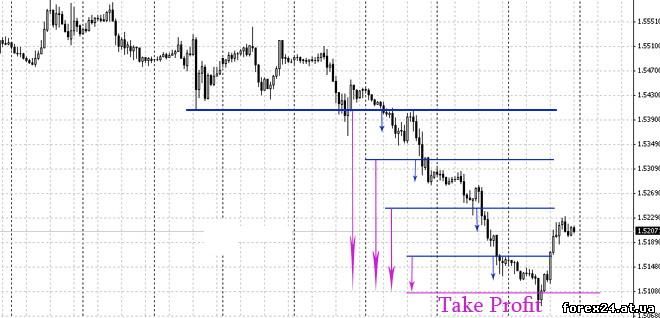

Not as easy as it might seem from the beginning. No one cancels this development as a reversal of the price against the trader. If a reversal started to happen with just one transaction, the trader can simply close or do averaging. If already in the market is, for example, 4 of the agreement, as shown below, and the price began to unfold, in most cases, the Stop Loss is set to the point total of all transactions breakeven.

That is, in this case all orders will be closed simultaneously so that the sum of the scores of all items would not be negative. Then, the trader will restore attempts to build a grid of orders, thereby accumulating trading volume in the direction of the price movement.

If you use pyramiding, the trader can long time to watch that moment, when I finally get to put, for example, 4-8 orders and then again to close them all. Are false entries, price reversals in the process of concluding new agreements, but use this technique speculators believe that it is sufficient to close the income and then all the expenses of their time and money will fully pay off.

Distinctive features of pyramiding in Forex trading:

• accumulate total volume of all items when moving in the profit direction

• new deals will not open if the price dropped out after the first operation

• series of positions is closed when a certain profit or after opening certain number of trades

• trade the highly volatile pairs

Typically, a series of orders is closed after the opening defined by the trader the number of transactions. This amount can be based on the volatility of the trading instrument at some other, from the point of view of a speculator, good arguments. When you close all orders received profit turns out to be really great, because at the end of the series, already accumulated a substantial amount on the instrument.

Of course, to increase the likelihood of positive developments, every speculator in its own way determines the time and the direction that should allow the order grid fully operative. The pyramiding requires traders some of the considerations that will be open the first transaction. Pyramiding is used as tracking orders, not to open or close.

Acceleration and pyramiding

Often use pyramiding it traders who are engaged in the dispersal of the Deposit. Important to them such is the dynamics and trading aggression which in this trading method a lot. You may choose the exponential increase in the amount of each subsequent deal, and besides, to do a very small distance between adjacent orders. Thus, this trading technique can be applied in different situations.

An example of aggressive trading can be a combination of pyramiding, unlimited averaging and martingale system. Here's a salad may be used if desired to accelerate your account. It is worth remembering that pure pyramiding only system that gives confidence to the trader, he was right with the direction of the price movement. Gradual "top-up" of the volume allows to reduce the likelihood of large errors. Here the speculator first, as if trying small lot, whether he understands the situation, and only then increases the volume.

|

| Category: Forex | Added by: (30.10.2017)

|

| Views: 370

| Rating: 0.0/0 |

|