|

Statistics

Total online: 1 Guests: 1 Users: 0

|

Trade

Risks of leverage in the Forex market

Leverage in the foreign exchange market is one of the main advantages and high risks. Various financial markets offer traders the opportunity to use more money than the speculators in stock, but the most impressive values of leverage there is on Forex.

Unfortunately, not all traders understand the risks of leverage, which appears a lot of ridiculous assumptions and assertions. Further examples will be presented to the real situation with leverage on Forex and risk.

The advantage of leverage trader can trade with more capital than is on your account. On the other hand, there is the possibility to acquire too large amount of the asset, but what is the danger? Go to details, where there are answers to most questions.

What is leverage - review with all the details.

Whose risks when using leverage

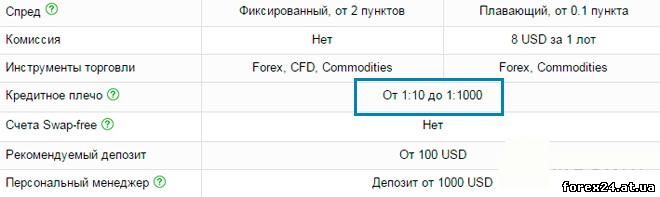

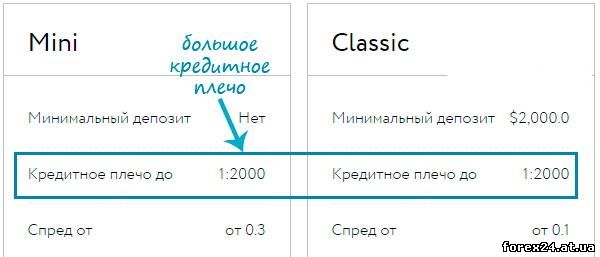

For Forex traders, as a rule, can independently set the size of the shoulder on your Deposit, or through the personal Cabinet or by contacting the customer support of the broker. One does not impose a specific value, and the company offers its customers a range of values, for example from 1:10 to 1:1000.

Now I propose to quickly recall what is the role of leverage on the Forex. For example, take 1:100 leverage which the trader wants to buy 1 standard lot EUR/USD (a value of $100,000). The no speculator on the Deposit of $100,000, but he uses the leverage of 1:100. In this case, to purchase a lot he doesn't need to have $100.000, and it is enough to possess $1000 (this is 1/100 of the required amount).

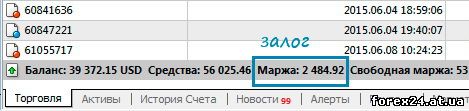

On Deposit broker blocks of $1000 (the Deposit) and $99.000 provides out of pocket (or the amount comes at the expense of the Bank, the company cooperates with). Why would the broker to risk your money due to the client, which, perhaps, does not know how to trade? In fact, the organization no risk.

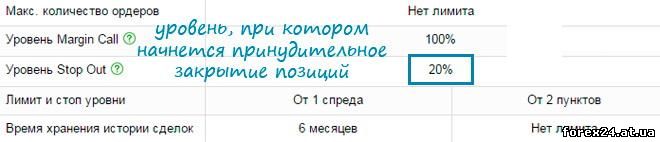

If the transaction customer will go loss, nobody will give rise to the value of $1000 - the transaction will be closed automatically as soon as the threat to the funds of the broker. For example, the loss on the transaction reached $850 and the position is closed, all the losses borne by the trader, and the company will not lose anything.

Accordingly, if the trader would open a trade for 1 lot, but leverage of 1:20, then the Deposit should be not less than $5000 (5000*20=100.000). In this case, the forced closing of the position with a loss on the deal at $4250 (the exact value depends on the trading conditions of a particular broker).

You need leverage to trade the Forex market?

Depends on whether the risk from leverage

It is believed that the risks in Forex trading is directly dependent on the size of the leverage. Let us understand and for clarity, refer back to the examples. Let the trader regains 1 lot, but he will do it on two accounts with different quantities of the shoulder. In the first case it will be about 1:100, and the second is 1:1000, but in both situations, the Deposit is $3000.

1. At 1:100 for buy 1 lot you need a Deposit of $1000, and the change in the market price of 1 point will be added or subtracted from the account of $10 (if the price is a plus for the transaction, for each item +$10, and if in the negative,- $10). For example, if the drawdown 80 pips trader loses $800 from their funds.

2. At 1:1000 to buy 1 lot already is enough only $100, but the change in the market price of 1 item will be as before to add or subtract from the Deposit of $10. At the same drawdown 80 pips loss speculator will be made up of former $800.

It turns out that the risks of leverage are directly not depend on the value of the item "attached" to the volume of transactions in lots. When you change the value of the shoulder the only difference is the amount of the bond, and it becomes only an indirect cause of increase/decrease of risk. Why this is so, why?

In this case, the problem can be categorized as psychological, because with a small mortgage from a speculator in Forex is not little available funds for which the person may acquire new volumes. The trader gets the opportunity to open more positions, in violation of the acceptable risks, the total amount of all open trades can be very large.

Margin trading - of credit funds

It significantly increased the volume of positions will affect the risks, as the value of one PIP equivalent to the market price will increase substantially and with a draft this situation will be dangerous. If the trader owns the other, has no idea about the risks (if it has, then in General it will be difficult for the Forex), then it will not play the role of the size of the leverage in his Deposit, of course, within reasonable limits (if very little I will not be able to enter into agreements, too much will be the Deposit).

To be afraid of the big leverage is not worth it, it gives a trader ample opportunities, but that does not mean that the speculator must immediately "on all cylinders" to use margin properties, position opening a huge amount. You can trade the same amount in accounts with different sizes of the shoulder and have the same risks.

|

| Category: Forex | Added by: (06.11.2017)

|

| Views: 353

| Rating: 0.0/0 |

|