|

Statistics

Total online: 1 Guests: 1 Users: 0

|

Trade

Stop the coup

First, let's clarify the terminology "stop" and "coup". Under stop often in trading means the Stop Loss order. Under the revolution should understand this situation: we have a buy position (buy), which identified and placed orders of Take Profit and Stop Loss.

If the trade is closed by stop, then immediately opens a new position in the opposite direction, that is for sale (sell). Looking ahead, I note that this kind of coup is not applied to any trading system. We should not blindly pursue the opening of new positions opposite to the previous one.

When you want to have?

In the context of this review, we will conditionally divide the trading system into two views. Some of the applications do not need to determine the probable price movement, but sufficient to understand the moment when a significant move is generally the most possible. For example, such a strategy is a breakout of Asian sideways. Recall that in the example examines the state of the market during flat.

Then, during the opening of the European session, the market expected a sharp price movement. The trader is in no hurry to assume which side is the movement, he will understand it later myself. It more important the moment beginning of the trend movement.

Another type of strategies are more accurate in your analysis of the options. In such systems, each operation "charaunitsa" written. For example, a trader using his method of analysis of the situation, has already decided it will soon sell a currency pair. He just need to wait a moment to receive the signal from your strategy. Just knowing that if there is a signal, be it buying, selling of option the speculator does not even consider. For such systems the techniques of coups, most likely, will not work.

The principle of the coup after stop

In Fig.1 we see the situation when the implementation of market analysis, it was determined two significant from the point of view of the trader, level 1 and 2. When the price breaks through either of the two levels for the speculator means a signal for opening a position in the direction of penetration. Price crosses the level 1 and the person makes a purchase of a trading instrument. Stop Loss of the deal is a significant level 2.

Almost immediately the price reversal happens in the opposite direction. Position becomes unprofitable, and then closes when triggered Stop Loss. At this point, a new position aimed now towards sale. Thus, the closing of the purchase and the breakdown of prices level two, is a signal to open new trades in the direction of penetration. As we can see, this method proved to be in this case justified.

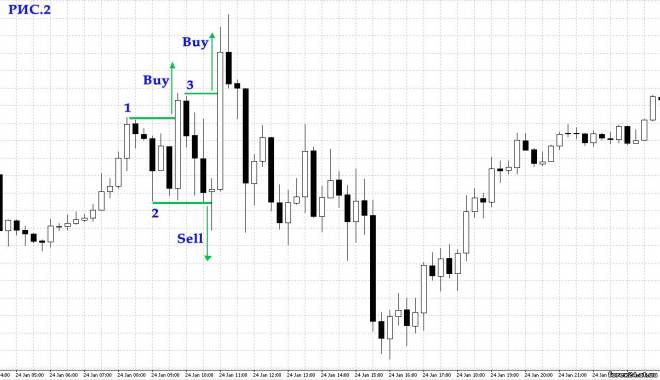

In Fig.2 similar situation, but with bad for a trader ending. As in the previous case, the speculator has identified some important strategies for levels 1 and 2. Is the penetration level of 1. The price movement up is false and the subsequent break of level 2 is closing the deal with profit.

The system opens a new position, now on sale from level 2, but the price is again unfolding, and we are seeing the pair. Stop Loss position is located on level 3 is activated locking the second losing trade.

From the same level opens a new position to buy, it is stop the coup. Thus, we see that for these strategies to coups threat is the situation of the gradual expansion of the range of price movement. With each new kind of round of price updates the local highs and lows, but not removed in any of the two parties in large extent.

Martingale flips

Along with upheavals in the trade rarely use the martingale principle. Some tracery believe that even if penetration level was wrong and the position is unprofitable, then the probability that the second break of the significant level will be much stronger.

If the second time the price will not be able to organize the market trend movement, then the third time, I guess. Of course, in fact, can be a large number of such bad punched, but because traders who use with the revolutions system Martingale, rely more on the classical postulates of probability theory.

In practice it looks as follows. On the same figure.1 the price breaks the level of 1, and then turns down to close positions with a loss and immediately opens a new sell trade. The caveat is that the second transaction will be a volume two times more than the first.

If the second position closes with a loss, will open a third in excess of their volume, the second twice and so on. Let the first position was 1 lot, 2 lots the second, and the third 4 lots. For simplicity, we assume that the values of Take Profit and Stop Loss in all operations are the same.

Thus, when closing with a loss of the first and second transactions, profit taking on the third will bring a profit of such magnitude that will not only cover losses but also will bring profit. It is understood that the use of such techniques entails very serious risks. Traders who use the upheavals and developments of martingale in your trading I hope that will not be in their job long series of failed positions.

|

| Category: Forex | Added by: (06.11.2017)

|

| Views: 820

| Rating: 0.0/0 |

|