|

Statistics

Total online: 1 Guests: 1 Users: 0

|

Trade

Strategy Price Action trading reversal pattern Rails

One of the most effective trading strategies Forex trading strategy Price Action, which was based on the analysis of the price behavior and patterns prevailing in the market the price (under patterns – from the English pattern, or "sample", "model" – in this case the mean of duplicate stable combinations of performance rates).

Although the strategy of Price Action does not involve the use of any technical indicators, it is based on one of the most important tenets of technical analysis – on the axiom "history repeats itself". This strategy allows with good accuracy to predict:

• the direction of the price movement;

• the entry points in a trending market.

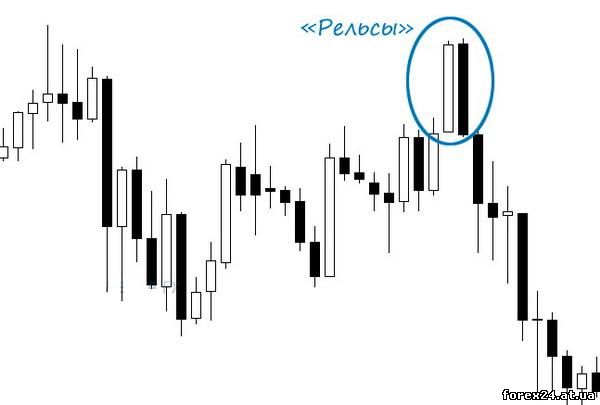

Distinguish patterns uncertain patterns continue the existing trend and patterns of trend change (reversal). Reversal trading pattern "Rails" is not among the most common, but those skilled in the art to accurately identify it on the chart, there is a serious chance for success.

Turn dubarry pattern "Track": get acquainted closer

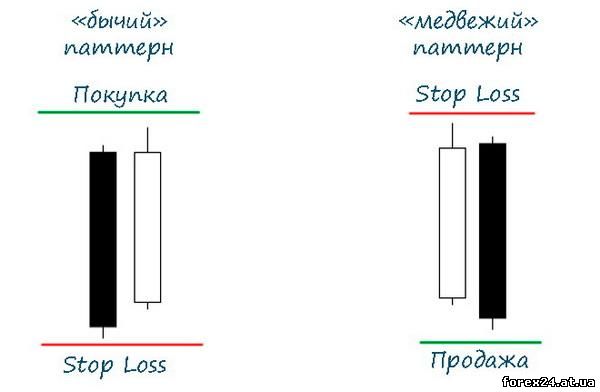

Price pattern called "Rails" refers to the pivot and is formed by two adjacent divergent candles. Ideally, the formed pattern must be above the level of the surrounding bars, and the prices of opening/closing should be close to the minimums and maximums (i.e. body candle of the pattern should exceed the body adjacent candles).

In the "bear" the first candle is white, the second black, in a bullish pattern – on the contrary.

The reliability factors pattern "Rails"

Increase:

• the formation of the pattern in the direction of the current trend (the entry signal in the direction of the trend)

• the patterning on Price Pivot Zones (PPZ) or at important price levels

• the patterning on the formation truhlarova swing-high or swing-low

• the long length of the pattern bars

Lowering:

• the formation of the pattern against the current trend (the entry signal in the opposite direction to the trend)

• the proximity of the pattern to the lines of support/resistance

• closure of the second candle of the pattern below the level of the mid

• small length bars pattern

Important: on the chart pattern "Rails" should be allocated explicitly and clearly, it will not have to seek out.

The use of the pattern "Rails" in the trade

When using trading strategies this tool is important to know that a warrant for the entry for "bear" pattern is below the minimum, and stop-loss placed above the high (for bullish pattern, and Vice versa).

Entrance into the market is pending orders that are placed for the bear pattern a little bit (5-10 points) below the second candle for bullish slightly above. Stop losses are exhibited in contrast to the input (slightly above or slightly below the second bar, respectively). Penetration of the exposed layer provides the entry into the market.

Take profit is recommended to be set at a level of 1.5 times the stop loss, it is also possible to close a position on reaching the nearest level of support/resistance.

Important: the end of pattern formation often (up to 80% of cases) accompanied by a "rollback" prices, and the traffic can be quite significant.

Pattern "Rails" I believe work only if the pullback does not exceed 50% (pattern) altitude, otherwise the pattern is about and to avoid big losses it is recommended that the operational closing of the order, even if it already contains a loss.

It is obvious that the pattern "Rails" requires a lot of experience, so it makes sense to practice the skills on a demo account (for example, the broker Tickmill, trading terminal which provides a demo account full correctness of submission of quotes).

|

| Category: Forex | Added by: (30.10.2017)

|

| Views: 402

| Rating: 0.0/0 |

|