|

Statistics

Total online: 1 Guests: 1 Users: 0

|

Trade

The correlation coefficient

Correlation is a statistical dependence of two or more independent from each other values (values, which are established at least to some extent). The change in the value of one of them changes the value others. As a mathematical measure of correlation between two variables is the correlation coefficient.

In the case where the change of value does not lead to a natural change another value, then we can talk about the lack of correlation between these variables. In the scientific revolution of the correlation for the first time began to speak, the Frenchman Georges Cuvier in the 18th century. He developed the "law of correlation" was intended to restore the species, with only part of it.

Correlation coefficients can be positive or negative. If the increase in one value decreases the values of the other magnitudes, then the correlation coefficient is negative. In the case where the increase in the values of the first object observation leads to increases in the value of the second object, it is possible to talk about positive coefficient. Another possible situation is the lack of statistical relationship, for example, for independent random variables.

The correlation coefficient [K] shows us how pronounced the growth trend of one variable when you increase the other. Its values are always within the range [-1:1]. Closer than the value of the variable to -1 or 1, the more correlated among themselves the value of interest. When K=0 it is possible to speak about the complete lack of correlation between the observed variables. If K=1 or K=1, then mention the functional dependence of magnitudes.

The correlation coefficient Forex

For every trader it is important to understand that we are dealing with instruments consisting of a pair of currencies. Unlike the stock market where, as a rule, each instrument is just one individual unit on the Forex is used to measure the value of one currency in terms of another.

While we rarely can observe the visual similarity in the movement of several currency pairs. This may be due to the fact that both pairs contain the same currency in both cases. For example, we can speak about correlation of currency pairs EUR/USD and USD/CHF with a negative value of K.

As an example of the correlation of two pairs with a positive, you can think about EUR/USD and EUR/JPY. In both cases, we buy the EURO and sell the second currency. Some pairs move relative to each other, but over time may vary. For example, to determine for their work the two correlated currency pairs is enough to find one from the entire range provided by the DC, which would have very low volatility.

In 2012 as such a tool could be EUR/CHF. It's not every day the width of its movement in the market would exceed 30 items, which can be considered a small value relative to similar indicators of other couples.

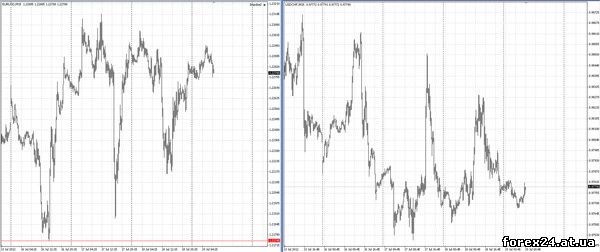

* to the left of the price chart of EUR/USD right USD/CHF. The correlation of the currency pairs with a negative coefficient

This currency pair can be easily decomposed into two pairs, using the currency that "dilute" the selected tool. For this we take USD, which will give us EUR/CHF, EUR/USD*USD/CHF.

Indeed, if you multiply the two new us dollar pairs, as a result, we again have studied EUR/CHF. This transformation suggests that both pairs will be correlated among themselves, as their work will demonstrate the value of the EUR/CHF pair, and they are relatively small, as mentioned at the beginning of the example.

For sure trading you need to have a clear view not only on the characteristics of individual instruments and how they interact with each other. There are trading strategies built using K. Can be used even overlay one chart on another, to identify similarities in price movements. The coefficient may be calculated anew, taking into account the latest changes in the behavior of price charts.

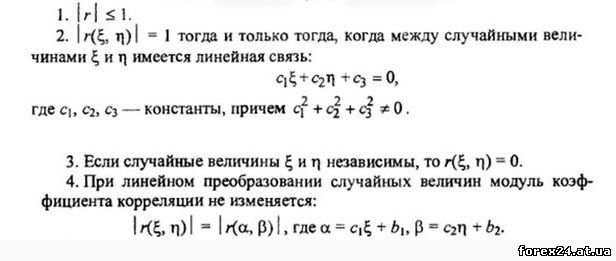

Properties of correlation coefficient

The symbol ξ and η are random variables

The application of correlation to Forex

One way of using correlation to trade pairs is to eliminate the differences of the instruments. For example, the trader has selected for the two currency pairs that are correlated with K = 0.8. In this case, when observing the movement of the subject, people will notice that from time to time change, then slightly increasing, then slightly decreasing. However, the average values of the coefficient are in the range 0.7<K<0.8.

As soon as the market comes a situation that To<0.4, for example, it will mean the presence of only partial compliance in the movement of both tools. That is, when the growth of one pair of the other growth will be very limited. But, mindful of the fact that these instruments are correlated with K=0.7 or 0.8, we can use this gap to their advantage by opening the position to bring together couples.

Finding such situations and further their use is the volatility value as We are unable to correctly interpret the new coefficient values, taking into consideration the expected gap, but later it may be that this new value of this ratio, which now will become permanent for a certain time. There are special correlation indicators that help the traders to monitor the convergence and divergence of tools, in other words, for changes of the current values of K.

It is difficult to overestimate the significance of the correlation coefficient in a market trade. Its usage enables you to look at investing more globally, given the pairs relative to each other. Another area of application factor was hedging. Wanting to reduce risks in their trading, speculators may carry out hedging not only in different markets, but also through correlated instruments. Thus, there is partial hedging.

|

| Category: Forex | Added by: (05.11.2017)

|

| Views: 470

| Rating: 0.0/0 |

|