|

Statistics

Total online: 1 Guests: 1 Users: 0

|

Trade

The pin bar and its application in trading

Let's start with the fact that the pin bar is a figure of technical analysis. With it, traders do not rarely find points of market reversal it helps in the process of opening the position. Today we take a closer look at what is a pin bar, how to identify it on the chart, as well as exactly how it can be used at the conclusion of transactions on Forex.

Pin bar (Pin bar) is a reversal pattern that allows with high reliability to determine the changing market trends. Best work out the figures on high time frames for example H1 and above.

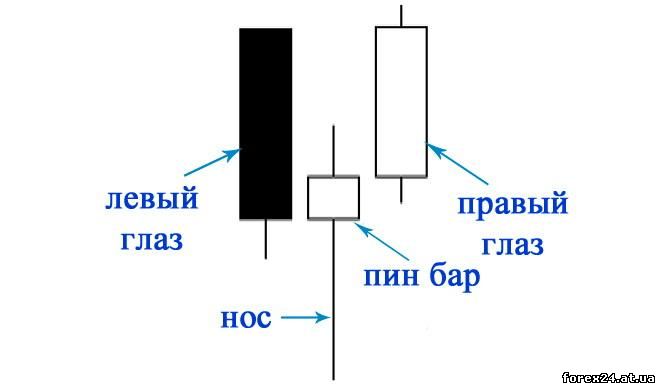

Where did this graphic figures appeared such a strange name? The fact that the component parts of the pin bar is:

• "the left eye"

• "nos"

• "right eye"

Probably many have already guessed, that name was taken by the famous character of fairy tales - Pinocchio. Let me remind you that this infantile hero was a very long nose, what is different and the pin bar.

Pin bar on the chart

The figure below shows the pin bar and the situation in which you can find on the market.

Please note some of the features of the pin bar:

• the body of the pin bar is several times smaller than the whole of its height (4-5 times)

• shadow (nose) of the pin bar is very long (estimated visually) and acts far beyond candles "left eye"

• the pin bar closes with a color, the opposite of "left eye"

Such graphical representation is, unfortunately, rare. Therefore, it is not necessary to work in the currency market only with the help of the pin bar, but rather, this method of reversal can be used as additional. Saw that on the chart emerges a clear pin bar, so it is advisable to pay attention to this and try to use.

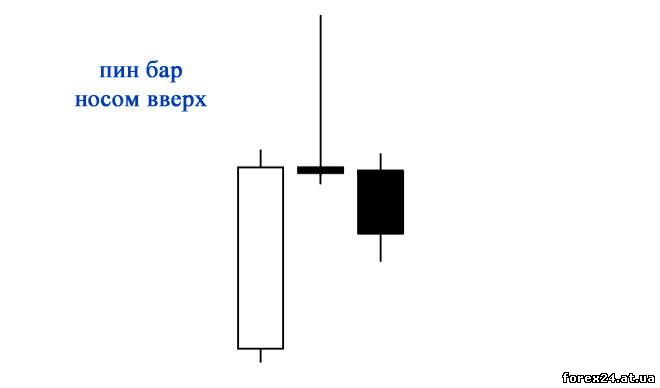

The following picture shows the reverse situation to our previous example. Now the nose of the pin bar is pointing up. The reversal can be in any of the parties. Again the graph shows that the pattern has a long "nose" and a small candle body.

It must be remembered that it is desirable to use this graphic figure in such places on the chart where a pin bar is already a prerequisite to reversal. For example, this can be a significant price level, a region near the pivot point or round price values. It is near with such market situations are most likely to be a full-fledged trend reversal.

Rules for opening trades at the pin bar

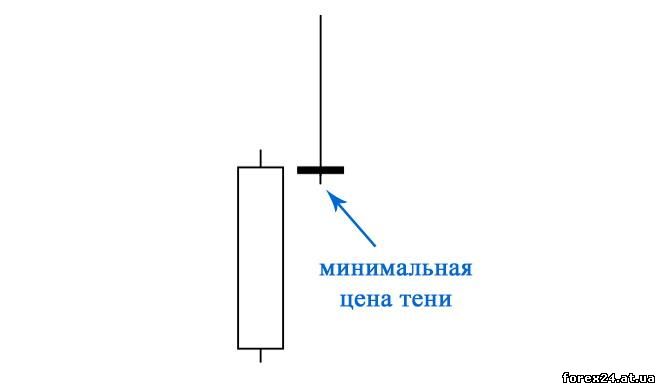

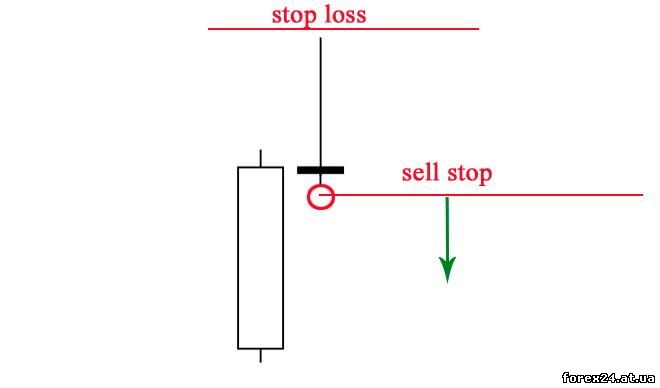

Trade on pin bar enables you to use pending order that is necessary to use. When the candle is almost closed, determine the minimum price lower shadows, if the nose of the bar up, and Vice versa, top price shade, if the nose of the bar pointing down. The example below shows the situation for a reversal for sale, and the opposite case will be absolutely the mirror.

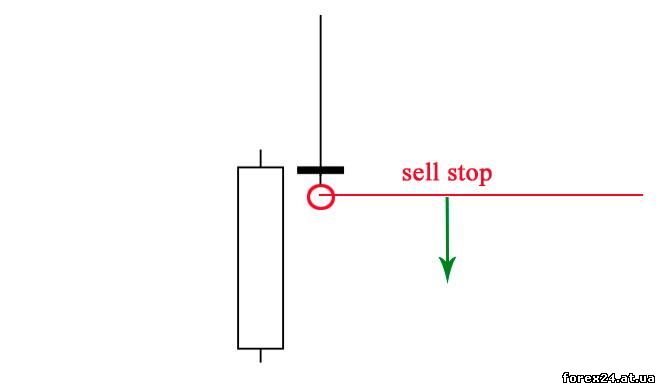

Now set the pending order in the direction of reversal of the market at a price that is below the minimum value of the shadows on a couple of points. In this example, it will be a Sell Stop that can be seen in the figure below. Of course, you can open a trade and the market, but what for once again to oppose the re-quotes if you can safely place a pending order?

After finding the entry point in the transaction, we begin to address the issue of installing a Stop Loss order. For starters, place it a few pips above the "nose" as shown in the following picture. The fact that the closing of each of the next bar the Stop Loss order us to move. This technique allows you to gradually reduce the size of the stop loss.

Note that it is possible with a pin bar to use other ways of closing the profit and loss, but in this article we look at probably the most effective option.

Stop Loss would be like, to move the market price, being constantly a little above the maximum prices. So what would the price to reach the order, it will have to overcome the maximum value of the previous candle. An example of how the Stop Loss moves, shown in the picture.

A Stop Loss order will be all the time a few pips above the candle, on which is located. Traders that prefer in one operation to accumulate large values of profit, generally do not use any other means of closing the transaction, except for Stop Loss. Thus, they "trust" price, relying on strong market movement after the turn.

Indicator Pinbar

In the beginning of the article You can download the Pinbar indicator, which is considered one of the best at finding "noses". Of course it's not perfect, but allows you to quickly see the shapes that can be pin bars. It should be remembered that in night and morning hours, when the American and European markets are still closed, a full market reversal is unlikely.

During these periods is to ignore the signals, concentrating only on those constructs that are observed in the period of high market activity.

Display "paints" the arrows are telling us that in his opinion on the chart there is now a pin bar.

So, unfortunately, the indicator does not always correctly assesses generated candles, taking as the pin bar such instances, which are the same color as the "left eye". There are theories and strategies, in which even such cases are considered to be full-fledged figures, however, signals are less reliable.

The pin bar in Forex, if we talk about TF from H1 and above, and not so common. It would be nice to combine this figure with other tools. To only trade pin bars, it may make sense, but only in the case if you use once a number of currency pairs, otherwise, the opening signal of the operation can wait for a long time.

To limit the possible profit on their own, for example using Stop Loss or Take Profit setting full. The theory of this shape refers more specifically to the search entry point, and not to methods of completion of the transaction. Indicator Pinbar should not fully trust, as it does not take into account the market condition and signals the emergence of figures with the same color of the "left eye" and "nose".

|

| Category: Forex | Added by: (30.10.2017)

|

| Views: 509

| Rating: 0.0/0 |

|