|

Statistics

Total online: 1 Guests: 1 Users: 0

|

Trade

The use of a trailing stop work with trailing stop

Today we will consider another way to support the open position, which is often called a trailing stop (Trailing Stop). The latest it becomes clear that this technique is designed to put an end to the work of the order. It is, "trawl" is most often used by traders who deal with the trend.

In such situations there is a desire to collect the profit from all price movements that go beyond a fixed Take Profit value. Usually, the speculator determines the beginning of the birth of the trend and open a position in the direction of the probable development of the price movement.

Actually trailing stop is for urging the prices as soon as it goes in the direction of greater profit. The trawl should be at a certain distance behind the price and the turn stops. Is often used this way automatic and semi-automatic trading. The person is able to open the transaction and enable an adviser "trust" profit.

If so to follow the position of the hands, you have to constantly move the Stop Loss with increasing profit on the transaction. Each new Stop Loss value is further from the opening point of the position, thereby ensuring the closing of the transaction with a large profit. When using a Trailing Stop value of the Stop Loss order does not increase the size of the loss, and only reduces it.

How does the trailing stop for example

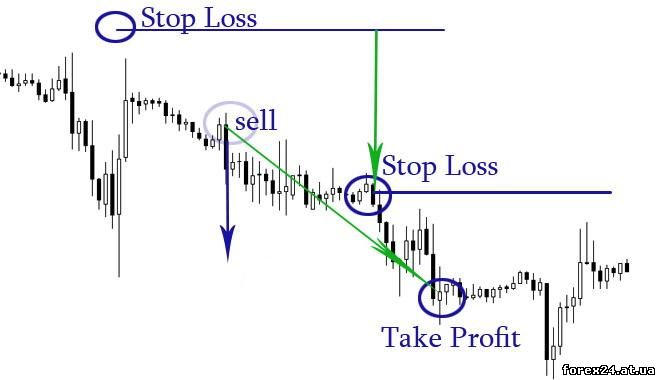

As mentioned earlier, in the trade using the trailing stop can not use Take Profit. Consider first the use of this technique without the participation of the restrictions on profits. In Fig.1 we see a price chart one day on the EUR/USD. The trader opens a short position (sell) when the price broke the previous local level (1). After this, you may exhibit a Stop Loss under the terms of the trading system of the trader, and may not be exposed at all. As we can see, price some time hovering around level 1, and then begins to decline.

For the trailing speculator determines the value in points, which is between the market price that moves in the direction of increasing profit on the transaction, and the Stop Loss order. The choice of values may depend on the particular currency pair and time frame (TF) used by the speculator. Another variable is the size in points, which is counted from the price of the transaction in the direction of profit. For example, if we take the distance in 30пунктов, the Trailing Stop will be activated once the market price reaches +30 PP profit on our deal.

In Fig.1 shows quotes for TF = M15 (each candle on the chart represents 15 minutes). For example, we determined in advance that the trade in the pair EUR/USD on M15 will enable trailing stop once the price 30 points. The second parameter, which independently select, the value of the distance in pips from market price to our trawl. For simplicity we take the value of 40 points.

When price was in the direction of profit 30 pips,Stop Loss moves to the opening price of the transaction, that is level 1 that is a translation of the order to breakeven. Then if the price reverses and goes in the opposite direction, the trade will be closed with zero. If the price is, for example, 20 pips in the profitable direction, the trailing stop moves to +10 pips from the open price of the transaction.

Why is it so? Because our Trailing Stop follows the market price at a distance 40 pips. 30 PP market has already passed to the time the trawl, and 20 more PP, which equals 50пп. 50 PP we subtract the distance of Tralee, we get 10 PP. Thus, with increasing profit on the transaction, the trailing stop follows the price (Fig.2). In case of reversal and convergence rates for the trawl, it stands on the site. If the price touches it, the transaction is closed.

A trailing stop follows the price at a distance 40 pips, based on the chosen values. What more in the profits price, the further away from the opening level of the transaction goes and trailing stop. The deal closes when the reversal of the currency pair will be enough to pass 40 points in the opposite direction, where already waiting for stop. As we remember, when approaching the market price to the trailing, the last does not move anywhere and stand still.

Features use trailing stop

When you work on big TF such as H4, the value for the trailing stop is chosen much larger than in our example. For example, the trawl can be enabled only when the price goes 100 pips profit, and then stop will follow the price of 150 points. Not rarely use Take Profit to lock in profits. Can be a trade that put up Take Profit = 150 pips and a trailing starts to work when passing a price of 30 points to accompany her at a distance of 40 points.

As a result, the price will be sandwiched between Take Profit and trailing stop that is already in the area arrived. Thus, a transaction in any case will close with profit. The question is only about the magnitude of profit. Purpose, that is Take Profit, should be chosen not randomly, but with the expectation that the market will be able one piece to reach for a warrant. If this happens, it increases the probability of fixation of profit on the trailing.

As You know, if the price immediately after the opening of the transaction goes to the region of loss, the trailing stop is not included. His task is to support the transaction, at the urging of the prices in industry profit. Speculators, who are making long-term agreements, often "trust" position for weeks as long as the trend turns against them, thus affecting the order.

|

| Category: Forex | Added by: (30.10.2017)

|

| Views: 420

| Rating: 0.0/0 |

|