|

Statistics

Total online: 1 Guests: 1 Users: 0

|

Trade

Trade in the Asian session.

Methods and styles of trading in the Forex market a huge amount, some eventually become more popular, others fade into the background. Besides the well known and proven over decades of practice trading tools, there are new, however, is not always effective.

Nothing to do with fashion, as well as the circumstances created by those who profit trade traders is not needed, doing their job. One of the main features of the Asian trade session the currency pair, having in its composition the banknotes of Europe and North America, most of the time are flat. According to trading tools is the trend of price movement are extremely rare.

What You will find in this review:

• the history of trading in the Asian session

• examples of effective strategies (links to them at the end of the article)

• why this type of trading is not very popular with many DC

• the result of a trade on the dollar bill in "night" session

• basic principles of trade in Asia"

The schedule of trading sessions on Forex.

Many novice speculators who are accustomed to appreciate the strong price impulses, long-term trends and generally high volatility on the market, with resentment against the Asian session. In her time, there is a flat, narrow price channel low volatility and almost complete absence of trends (remember, it is not about all currency pairs).

The Asian session coincides with the night time the Central part of Russia, so you can often hear this type of trading is called night. Why do we need trade a night? The whole thing is in sustainable market patterns, often neglected by novice speculators. We are talking about a fairly stable price channel, which can be used to trade in the Asian session.

A bit of history with trading in the Asian session

The flowering night trading occurred in 2007-2009, when this kind of scalping has become the most popular trend in Forex trading. How to tell experienced currency speculators, at that time the main topic of discussion the Forex traders were just scalping in the Asian session. What happened, why the situation has changed?

Professional trader Vladimir Highlanders (Volozavr) sees several reasons for the popularity of night trade:

• trading in the Asian session thanks to the numerous at the time of scalper EAS (held for trading in price channel) became very profitable, affordable and relatively simple that I could not like dealing centers (DC);

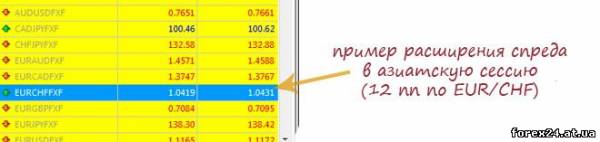

• the company intentionally began to worsen terms of trade, the polls widened the spread on running in scalper currency pairs, prescribed in the client agreements clauses that prohibit scalping trades (all trades, the duration of which, for example, less than 5 minutes, and the result of the operation at least 5-7 points);

• the promotion and creation of convenient conditions to increase the popularity of another style of trading, which is often called a martingale+averaging or simply averaging.

Even new traders are able to get a good Advisor-scalper, free download for it installation in one of the topics on discussion forums to earn money. Of course, there were difficulties, but in any this type of trading has become bring in good money for many people. Naturally, DC, who earn on clients losses, could not accept this situation.

As a result, the interest of the majority of novice traders have switched to trading methods, built on averages and night scalping was nearly "strangled". However, most experienced traders were able to adapt to new circumstances, but it was only a few percent of the number of people who were engaged in trade in the Asian session to "persecution".

Gradually the market was entered by new companies, enlarge, spread, does not prohibit scalping, they began to be lifted the restrictions in the old DTS, but the popularity of "trading in Asia" is not returned. Still most popular among speculators strategy this system using the principles of martingale and averaging, namely the concept of "advisors" (automated trading system) is now associated in the vast majority of traders with such works as Ilan (martingale+averaging).

General principles for trade in the Asian session

Good specialists in this method of trading very little, but they are in financial terms feel. Speaking with Vladimir Vladimirov Goravan on night scalping, you hear a little arrogance and a lot of irony, but his opinion is hard to disagree with new coming on the market, follow the path of least resistance.

This is reflected in the use of automated systems, which are averaged and do not cause any inconvenience to the owners, including in the form of losing trades. However, then have to put up with completely drained the account, but who wants to think about the bad? Every newbie comes to Forex thoughts about earnings and not about the risks of losing their capital.

The whole principle of trading during Asian session is reduced to the construction of the price channel in one way or another (that is, the indicators you can use other tools) and the conclusion of agreements "on the rebound". The market price as if reflected from the wall of the price channel and turns in the opposite direction:

Why traders do not fear that there is a break of the channel? Here we must recall that the main feature of the market during the Asian session - the almost complete absence of trends. Even if such unpleasant event will happen in each transaction is short stop. An important point that you should never forget that our goal is on the market is that you will get a loss really, it is that the total result of successful and unsuccessful transactions were positive.

There is nothing wrong with that, for example, 2 out of 10 trades will end with a loss, however, for generation of traders, "grown" on the averaging strategies, this may be something new.

Why in the Asian session market, usually calm? At this time, not working liquid European markets, as well as the most powerful platforms in the US. Who is most needed, for example, Euro, us or canadian dollars in Asia? And almost anyone there and calm the behavior of prices, which just "fail" that would break the channel.

Effective strategies for trading in a price channel:

• Channel strategy Forex

• The return strategy

Trading system this group may differ on a number of parameters:

• the method of constructing the channel

• options filter false signals

• principles of position tracking

• methods of closing deals

Plus, it must be remembered that the system for the night market always time-limited work, which may coincide with the period of the Asian trading platforms or less in duration. Trade in the Asian session it is a subtle method of trading, but very effective, because they are, as a rule, experienced traders.

|

| Category: Forex | Added by: (30.10.2017)

|

| Views: 1392

| Rating: 0.0/0 |

|