|

Statistics

Total online: 1 Guests: 1 Users: 0

|

Trade

Use a Keltner channel Forex

The Keltner channel is a very popular kind of price channels. These technical analysis tools have long been used by traders and how to trade with the trend, and for transactions in the flat. Today we will examine a way of using the Keltner Channel indicator.

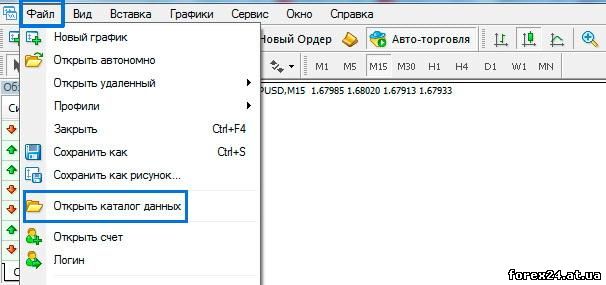

Below You can download free Keltner Channel indicator. The installation can be easily accomplished in a few minutes, as shown below. The illustration indicates that you need to run Your MetaTrader 4 client terminal click "File", "Open data folder", select folder "MQL4" and copy the file that you downloaded in the "Indicators". Now close the terminal and then run it.

I recommend to read the article about trend analysis. This information will be required to work with a price channel.

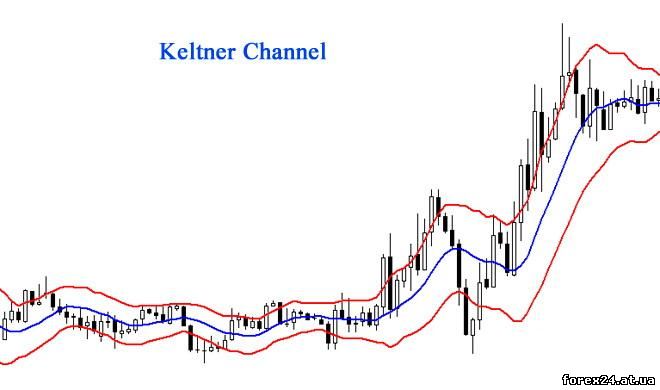

Sets the Keltner channel on the chart is exactly the same as any other indicator. Should appear three lines, as shown below. To make it easier to analyze the market situation, advise to set in the indicator settings the fat lines on a value of 1 or 2.

The indicator plots on the chart the channel, consisting of three lines. The red curves are the boundaries of the Keltner channel, and the blue line is the average values of the indicator. Typically, all strategy based on Keltner Channel, consider the closing of the candle (bar) outside the boundaries.

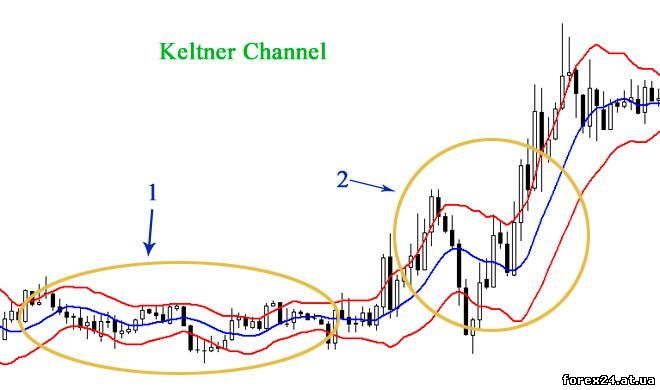

In the illustration below You can see an example where the candle closes outside of the channel, which is a signal of the transaction when trading with the trend.

As mentioned above, you can trade in the breakout direction of the gauge's border and in the opposite direction. The choice of direction of opening of the transaction depends on market situation and time of day. Trading on a "retreat" from the border as often seen in the night (Asian session), when the market is most of the time in the flat.

During the work of European and American platforms traders usually trade in the direction of a "breakdown" of the border. The market situation is reflected in the width of the price channel. When the indicator shows the divergence of the boundaries, which is marked by number 2 in the figure below, speculators avoid "bounce" deals, but if there is a restriction, as you can see under figure 1, that do not fit the "breakthrough" agreement.

Trade with the trend by Keltner channel

To work the trend is chosen the time when the currency pair, which is used in trade, the most agile. On the chart, it will look like the expansion of the boundaries of the indicator. This state of the market most suited to work the trend.

As a signal to open a position is taken the candle closed outside the price channel Keltner. As soon as we see this situation, immediately conclude a deal in the direction of the breakout line, as shown below.

The Stop Loss order should be placed at the opposite boundary of the channel. As market movement indicator line will move, and this means that the location of the order limiting damages are also need to change. The picture below shows the situation when the was set a Stop Loss when opening positions, but after a while, he changed his location.

It is seen that in the example the Stop Loss is gradually reduced, following the boundary of the channel.

To close a position can be used in this case only Stop Loss order. If you want you can find the right setting for Take Profit in points, based on average figures Forex time frame chosen for the trade. Thus, the market price would come out sandwiched between two orders.

The second use Keltner channel to consider in this article, we will not, as it applies more to night scalping. Work in a price channel "lights out" is another principle of trade than under today option trading according to the trend. With night scalping use price channel for "demolition" of the trade, You can learn about in another review, by clicking the link above.

|

| Category: Forex | Added by: (05.11.2017)

|

| Views: 370

| Rating: 0.0/0 |

|