|

Statistics

Total online: 1 Guests: 1 Users: 0

|

Trade

What are they and how to protect themselves from them

Requotes is the failure of the broker to perform the transaction selected by the trader price. See these information boards at the attempt of the trader to execute a trade at market when the price is quickly changing its meaning. This kind of trouble occurs on accounts that use the method of execution Instant Execution.

Such expressions as "prerequisite", "otrabotal", "meet the requote" mean that a person is not able to make a deal, because all attempts to buy or sell a certain volume of trading instrument he received a requote. As a rule, these restrictions have to face when price is changing rapidly that you can find on Forex during news releases, for example.

They allow the trader to conclude a deal on the price at which one wants. Having received a few requotes in a row, the speculator may detect that the current market price it is not enough, and thus attempts to open a position is complete.

Struggle with requotes

There are several ways to avoid market failure in the open position:

• trading accounts with Market Execution execution

• work in a quiet market

• to set the permissible deviation in points

The very feature of Market execution implies the existence of requotes. You can read more about Market Execution in a special article, the link to which is above. If, however, briefly describe the reason for this particular "market execution", it's all about the handling mechanism of the application of the trader. With Market Execution the transaction will be opened anyway, but perhaps not at the price at which the speculator.

Working with Market Execution, we are always able to conclude an agreement, but the precision of this may be what is called a limp.

Trading in a quiet market, of course, can be a way out, but not all satisfied with this option. In a quiet market, the price changes slowly, this means that from the moment of pressing the button buy or sell the currency pair to the moment of processing the order, the price can't change. In this case, the position will be opened at the price we got when clicked on the transaction.

Of course, for example, that when important news has to work can not leave. The difficulty will be and when the market "comes alive" when starting an active trade. In such periods, the market price of actively changing their values that will not allow you to trade on accounts with Instant Execution without requotes.

Setting the allowable values of deviations from the selected price is probably the most popular option, resorted to by traders who are not willing to put up with the requotes. This permission speculator to open position at a price that differs from the selected value in the trading process on the specified number of points.

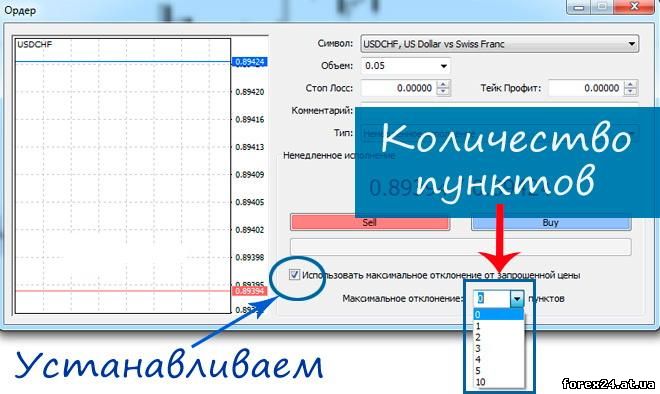

Here is an example. First, the tolerance is zero. What would it change enough to cause the window for the transaction, is ticked, as shown below, and specify the maximum deviation in pips.

If we want to buy a certain amount of a currency pair at the current market price 1.5590 and are prepared to sacrifice, for example, two points, the settings of the deviations exhibited figure 2. This means that if you click on the button "Buy" when the market price of 1.5590, we will not receive re-quotes at offset prices on the value of 1.5591 and 1.5592. The transaction will be concluded at the price that will be relevant at the time of execution, if it does not differ from the selected value of the trader (1.5590) more than 2 points.

If the market will sharply jump to 1.5593, we will again see the information plaque that the price is unavailable. To choose the value of deviation is to the circumstances of the trade, as if working with the news even two points may not be enough. Of course, you can say that it is actually the increase in the spread that we pay for each transaction.

• Position could be opened at 1.5590 and would be closed, for example 1.5600. If the spread is 3 pips the trader profits from this transaction amounted to 7 points.

• Position at a deviation of 2 points will open at a price 1.5592 and closed at 1.5600. If the spread is 3 pips the profit of the trader from this trade will be only 5 points.

You can prepare the trade in advance, putting the value of the deviations to which we agree. When the market is calm, then you can just uncheck use protection requotes, and if you begin to trade on an active market, it is quickly possible to return all into place.

Is there any sense at all to work on accounts with Instant execution, there are opening positions in a rapidly changing market? Yes, this may be the trader, especially if the work requires a high precision implementation of the application. For example, it can be a trading system based on scalping where due to requotes, the speculator may remain without positions in the market. The choice of the trading account depends on how the dealer is going to work on Forex.

|

| Category: Forex | Added by: (05.11.2017)

|

| Views: 418

| Rating: 0.0/0 |

|