|

Statistics

Total online: 1 Guests: 1 Users: 0

|

Trade

Whether to trust Forex equity?

The market rate  of the ruble again showed its peak, banks take licenses, and other well-known options for investing money or bring in a meager income, or smell of rotten fish. Still, 1998, 2008, and 2014 should lead many Russians to believe that to keep the ruble is not profitable. However, the Euro and the dollar, too, with the years of losing purchasing power, albeit slower than "wooden". of the ruble again showed its peak, banks take licenses, and other well-known options for investing money or bring in a meager income, or smell of rotten fish. Still, 1998, 2008, and 2014 should lead many Russians to believe that to keep the ruble is not profitable. However, the Euro and the dollar, too, with the years of losing purchasing power, albeit slower than "wooden".

The Internet is often said about Forex, binary options, but is it possible to rely on such ways of earning, not too everything is doubtful? Today I'll tell you more about whether or not to trust Forex, example of this market, as it is now the most popular in the CIS.

Do not want to repeat about what is Forex, so that this information is better read in a special review. Suffice it to recall that trading in the foreign exchange market we can only through intermediaries - brokers, so this time it is better to take as fact.

The credibility of Forex: how to earn here

There are two fundamentally different approaches to work on Forex:

1. You will be a trader (buy and sell currencies on their own, earning on the difference in market rates).

2. You will be the investor (handing money over to the management professionals who have experience and positive results).

Next, let us examine the basic principles of earnings for both options. Let's start with the independent trade, there will be clear why a great number of people trust Forex.

Independent trade

Forex traders constantly buy and sell certain volumes of currency pairs, calculated in lots. The market rate changes all the time, and this is clearly seen on the chart, in real time. To watch the market to see the market rate of any asset, is to download the trading terminal MetaTrader 4 (common) and install it on your computer or smartphone. It can be done here, after a quick check there.

The terminal set for a few minutes, after which we are able to keep track of any currency, assess the situation, build their forecasts. If you open there real trading account, then in the same terminal it will be possible to conclude transactions.

Why do people trust the Forex? Because it is the most liquid market in the world, the biggest currency "exchanger". It to exchange currencies, banks, corporations, insurance companies, investment funds and so on. The price is constantly changing due to changes in the ratio of volumes of orders for the purchase and sale, which at the moment is more wins.

For example, if buyers more than sellers, then the price will rise, and when the situation changes, the market rate will start to fall. This is a normal market principle, because if the market will stand only one seller that sells strawberries, and around a lot of customers, he can afford to raise the price and to profitably sell their goods.

A brokerage company that allows clients to trade on Forex market, with each transaction takes a small Commission, often referred to as the spread. The principle is about the same as in the Bank when they take a fee for the transfer of client money or for other services.

The trader buy a certain amount of a currency pair (depending on the capital of a merchant) when a high probability of rising market prices in the near future, and sell when the market rate ready to fall. How to identify in advance such a situation? Foreign exchange speculators use Forex strategy.

Investment trust Forex Manager

On the market there are specialists that seek to earn money not only through trade "your", "investor" capital. As a rule, all risks borne by the investor, so that if suddenly there will be losses instead of expected profits, then it is not a problem Manager.

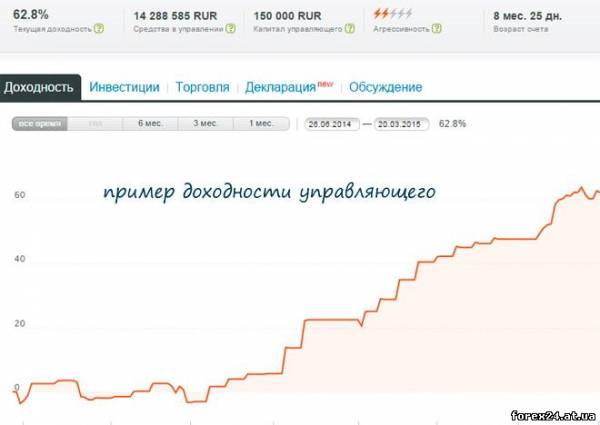

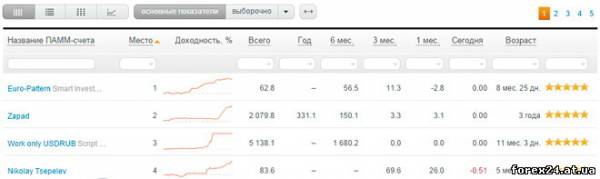

On the other hand, Forex is organised the so-called PAMM system, where you can observe the process of work, and most importantly, the results of the various trading managers. There you can understand who so many traders trades in the market, what his successes have been sagging and so on.

How to invest in PAMM - all described in detail.

In addition, it is possible to divide your capital into parts, investing in different PAMM-accounts. This is very convenient because risk diversification reduces the overall risk of the entire investment portfolio. Each Manager takes a certain Commission for their services, which in most cases is a part of the profits (30-50% of the income of the investor).

It turns out that the Manager did not earn itself, if you can not bring profit to investors. Use the capital customers he can't (technical limitations in the PAMM system, so that no fraud can not be in the plan). After the end of the next reporting period part of the profit is automatically transferred to the PAMM-Manager system, and the other part to the investor.

Special trust on Forex are managers who trade for a long time and show a stable growth of your PAMM account. In General, a PAMM-account is not only convenient payments, but also the security of investors ' capital and the ability for managers trading on one Deposit, to manage the funds of hundreds or even thousands of investors.

As you can see, in Forex all the mechanisms of long-established and are stable, so can be considered independent trading and investing in the PAMM to make money on the foreign exchange market. If you do not want to waste their time or to understand the intricacies of the trade, it will be easier to invest in multiple managers on Forex one of the reliable PAMM systems, for example, Alpari (the first and biggest PAMM-system), which is over 15 years of experience have earned the trust of the Forex traders and investors.

|

| Category: Forex | Added by: (30.10.2017)

|

| Views: 402

| Rating: 0.0/0 |

|