|

Statistics

Total online: 1 Guests: 1 Users: 0

|

Trade

Who sets the price of Forex? Pricing in the foreign exchange market

The market price of any asset on all financial markets is constantly changing. This can easily be seen simply by opening chart in the terminal, for example, MetaTrader 4. The rate of change is not stable, and sometimes the market as it progressed, and at other times "flying arrow in the side.

Logical leaves the question, who sets the price of Forex? Can't price itself to change as she wants, there has to be some principle of change.

Manually no quotes on financial markets does not change, it can only do aggregate amounts of all bidders. For example, if the purchase requisition is greater than for sale, the price is automatically increased and Vice versa. Below, a detailed look at the mechanism of changes in market prices on the Forex market.

Pricing in the financial markets

The principle changes in the market prices only in any marketplace, be it Forex or stock market. The whole process is automated and configured so that it takes into account the bids of buyers and sellers the same price.

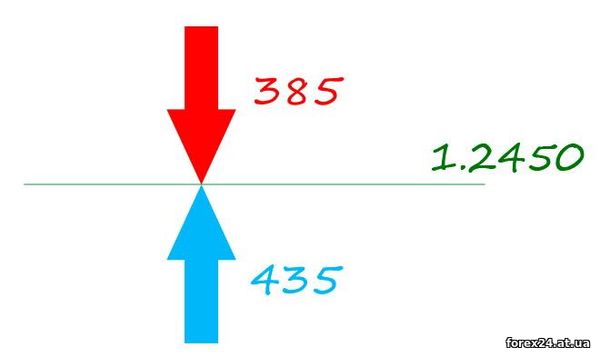

Consider the example when the market is at the level of 1.2450. In this sense, for example, the volume of bids of all buyers is equal to the conditional value 435 and sellers 385.

It turns out that all the positions of the sellers will be closed, but not all buyers are satisfied (435-385=50). The market price is willing to sell, and buyers (50), so she shifted to a point above 1.2451 to find sellers there.

I recommend to watch the video (7 minutes), again, explains the principle of the formation of price levels. In fact, this is the principle of formation and changes in market prices.

Imagine that not all buyers of volume 50 are satisfied with the price 1.2451, because some traders were willing to purchase the asset at 1.2450, but 1.2451 say that it is expensive. So with 50 up and moving to, say, 35, but also added new customers who have just "joined the game".

At the same time, sellers in the 1.2451 level should be even greater than it was at 1.2450 as the rate of sale has become more profitable. If 1.2451 again, buyers will be more, then the price will rise at 1.2452, and if you win the volume sellers, in search of the buyers market will come down again to 1.2450.

The change in market prices on the Forex

As you can see, nothing tricky in the pricing of Forex no, there's someone more, and pushes the price. Naturally, the "oil to fire" add news and all sorts of other events, when the enthusiasm of one of the parties (buyers or sellers) increases. In these circumstances, sellers may be on the market much more than buyers or Vice versa.

This effect is clearly visible when important market news, the schedule of which You can read here (constantly updated data). In this case, seeing new economic data, traders reconsider their positions, which is not rarely leads to a serious imbalance - buyers can be much more than sellers, causing the market rapidly begins to grow up.

Gradually the exchange rate will be higher and many traders believe it is too high, even taking into account the information that was declared. In this case, the volume sellers outweigh the volume of buyers, because of overvalued exchange rate beneficial to do sales. The result can be observed a sharp increase in prices and the equally sharp drop, which is called correction.

This means that the market is now correcting after a significant change of course. By the way, talking about the correction during the growth of the market after a significant drop, so this concept holds true for any trend, be it upward or downward movement.

As you can see, everything is decided by market participants, not separately, of course, and in some way collectively (summation of volumes). What is important is not the number of buyers and sellers, and their total volumes, as it claims "looking for" his contractors, and if they were dissatisfied (no counter orders the required volume), then move the price further.

Now it is clear who sets the price in the Forex market, so you can not worry about possible fraud. The whole pricing process is completely transparent and does not depend on certain stakeholders.

|

| Category: Forex | Added by: (06.11.2017)

|

| Views: 315

| Rating: 0.0/0 |

|